Rural Women Make Their Presence Felt in Rural Banks

A little more than half of the 500 million no-frills Jan Dhan accounts opened in India in the past nine years belong to women. Access to banking has enabled rural women to be in charge of their own finances and their children’s’ future.

Shanti Devi sleeps well knowing her money is safe in a bank. The 30-year-old who lives in Kalwari village in Sitapur district, Uttar Pradesh, remembered secreting away money she had managed to save in the thatched roof of her hut.

“But, I lost the money so many times to termites or fire. Now I have a bank khaata (account). It was opened a couple of years back when an official from a bank told us about the benefits of having Jan Dhan khaata,” Shanti Devi told Gaon Connection. “My money is safe in my account. I had to pay nothing to open the Jan Dhan account,” the young woman added.

Having a bank account has ensured a modicum of financial security to many women like Shanti Devi who live in rural India. Her neighbour Rambheji Kumari said that the money she received as part of the central government’s Janani Suraksha Yojana for pregnant women, was deposited in her no-frills Jan Dhan account.

“I received Rs 6,000 in my Jan Dhan khaata in three instalments for my pregnancy. The money will help my family survive should the crops fail, or if there is some emergency,” said Rambheji.

The Pradhan Mantri Jan Dhan Yojana (PMJDY), also known as the National Mission for Financial Inclusion, provides financial services such as a basic savings and deposit account, remittance, credit, insurance, and pension to the Jan Dhan account holders. It was launched in 2014 to make banking services accessible to those who did not have a bank account in their name.

According to a press statement issued by the Union Ministry of Finance on August 18 this year, in nine years [2014-2023], the number of Jan Dhan accounts had crossed 500 million.

Of these, 67 per cent are in rural or semi-urban areas, and every second account (55.5 per cent) belongs to a woman.

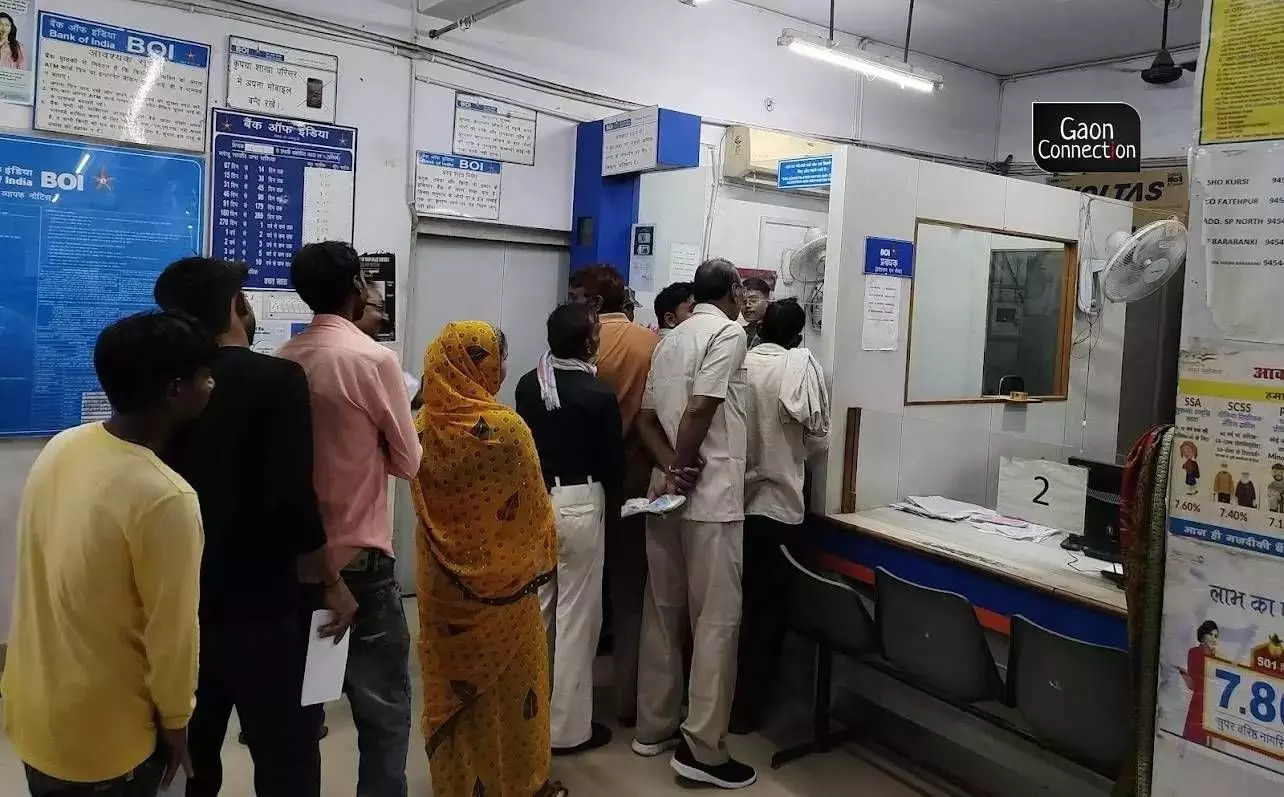

In Uttar Pradesh, Barabanki, bank officials informed Gaon Connection that it is because of the Jan Dhan scheme that the presence of women customers in the banks has increased.

Shivam Singh, manager, Bank of India, Belhara branch, in Barabanki said that more than 50 per cent of the Jan Dhan accounts in his bank belong to women.

“Earlier, women were rarely to be found in the rural branches of banks. It was a male domain but not any more. Rural women have become confident of managing their finances and they visit the banks to deposit or withdraw money from their Jan Dhan accounts,” Singh told Gaon Connection.

Bridging the Gap

Jan Dhan accounts are bringing rural women closer to the government and helping them directly avail the benefits of various welfare schemes such as Pradhan Mantri Ujjwala Yojana which provides a subsidy for buying a gas cylinder, the Janani Suraksha Yojna for pregnant women, and so on.

About 1,000 kilometres southeast of the Bank of India branch in Barabanki, Uttar Pradesh, lies the forest village of widow Aqila Begum. The resident of Tatraharting in West Singhbhum district, Jharkhand, said the Jan Dhan account has made it easier for her to claim her old age pension under the Indira Gandhi National Old Age Pension Scheme.

“After opening the bank account I have been receiving the widow’s pension and gas cylinder subsidies. I also got the money for a house under the Indira Awas Yojna into my bank account,” 70-year-old Aquila Begum told Gaon Connection.

In the neighbouring state of Odisha, Rukuni Rout from Kajala village in Kendrapara district, has held a Jan Dhan account for two years now.

“Earlier, I had no bank account. After opening the khaata, I deposited Rs 10,000 in the account from my savings,” said the 38-year-old whose husband is a truck driver. “The financial assistance of Rs 500 per month during the COVID-19 lockdown provided me with great respite as the household income had reduced considerably,” she added.

Within 10 days of the nationwide lockdown which was imposed in March, 2020, on account of the pandemic, more than 20 crore (200 million) Jan Dhan accounts of women were each credited with financial assistance of Rs 500 per month for three months through direct bank transfer.

Breaking the Gender Barriers

Financial inclusion is empowering rural women. Archana Devi, who lives in Khamariya village in Barabanki district, told Gaon Connection that before she had a Jan Dhan account, there was just her husband who had a bank account.

“Only the mukhiya [leader] of the family used to have a bank khaata and all other adults were dependent on him for finances. Now, I can save some money from household expenses and deposit it in my account.

It makes me feel confident,” said Archana Devi. Similar views were expressed by Lalita Singh, a 45-year-old from Belhara village: “I can withdraw the amount received under various government schemes. It has also made me more conscious of saving money.”

Being enabled to handle their own bank account has come as a great source of comfort to many women. “The men spend their money recklessly on alcohol or smoking. I often hide some money from my husband and use it in times of crisis. The Jan Dhan account helps me keep my money safe and the banking agents motivate me to save more money,” Rajsi, a villager from Mohammadpur village in Lucknow told Gaon Connection.

“It is because of the Jan Dhan account that I am able to plan for my kids’ future in a more efficient way. I am not required to share the bank details with my husband as he cannot access my savings without my consent. When it comes to my kids’ future, I cannot rely entirely on my husband,” she added.

However, there are gaps to be filled. Research articles published by India Development Review say that a majority of women who hold a Jan Dhan account are not using it to their optimum benefit.

While many of these women are using their PMJDY accounts, they are doing so only to access the benefit transfers they receive from government initiatives. According to research, they are not using their PMJDY accounts to deepen their financial engagement, such as saving, building account and credit histories, or accessing other financial products such as microinsurance, pensions, or micro-loans.

Source: GaonConnection