On an annual basis, Kuwait’s holdings of US bonds declined by 16%, at a value of $7.5 billion, to reach $39.3 billion, compared to $46.8 billion at the end of March last year, reports Al-Anba daily.

Kuwait diversifies from the US bond portfolio between short-term bonds at a value of $3.41 billion, while the largest percentage remains of long-term bonds at a value of $35.88 billion.

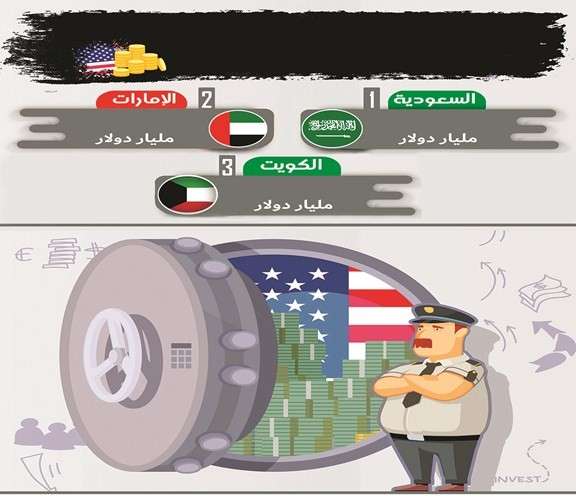

Successful movements of Kuwaiti investments in US bonds appear by reducing and raising their holdings by billions in recent months, while these moves coincide with the change in the return on those bonds as well as the increase and decrease of Kuwaiti investments in US stock exchanges. Kuwait ranked third in the Arab world, after Saudi Arabia, which ranked first in the Arab world by acquiring US bonds worth $116.2 billion, and the UAE came second with $61.5 billion.

In the Gulf context, the strategy of the GCC countries towards US bonds varied between buying and selling during March, as the investments of the Kingdom of Saudi Arabia rose to 116.2 billion dollars, compared to 111.7 billion dollars last February, of which 103.2 billion dollars were long-term bonds and 12.99 billion dollars short-term bonds; while the UAE’s investments declined during the month of March, reaching $61.5 billion, compared to $64.5 billion last February, of which $42.11 billion were long-term bonds and $19.39 billion were short-term bonds.

At the global level, Japan maintained, for the forty-sixth consecutive month, the first place during the month of March, by acquiring US bonds worth $1,087.7 billion, higher than last February’s levels of $1,081.8 billion.

China also came in second place after Japan, with $869.3 billion, higher than Last February, amounting to $848.8 billion, and thirdly, the United Kingdom came with $714 billion, higher than last February’s levels of $643 billion, and Belgium came fourth with a value of $336.5 billion, up from February’s levels of $330.9 billion, and Luxembourg ranked fifth in the world with $328.6 billion, down from last February’s levels of $327 billion.

In general, the volume of US Treasury bonds at the end of last March amounted to $7,573 billion, compared to $7,604.4 billion for the same period in 2022, i.e. an annual decline of $31.4 billion, or 0.41%, while foreign possessions of US bonds increased during the month of March, to reach 7402.5.