EFG Hermes recently issued a report indicating that Kuwait’s financial standing will remain robust in the mid-term, bolstered by investment income, owing to high oil prices and strong returns from the sovereign wealth fund saying Kuwait is poised to maintain a surplus in the fiscal year 2023, amounting to 23 percent of the gross domestic product (GDP).

This surplus, the Al-Rai daily has learned, is projected to continue into fiscal years 2024 and 2025, albeit at more moderate levels of 5.4 percent and 6.6 percent, respectively, due to a decline in oil prices.

Upon analyzing the budget presentation from the Ministry of Finance, which excluded investment income, Hermes anticipates a budget deficit over the next two years, amounting to 7.4 percent and 6.4 percent of GDP, following Kuwait’s substantial surplus of 12 percent recorded last year.

Hermes highlighted that the expected deficit is smaller than the government’s estimated deficit, which was based on a moderate oil price assumption of $70 per barrel. They believe that the projected deficit for the fiscal year 2024 is unlikely to pose significant financing challenges, given the strengthening of the General Reserve Fund through a surplus of 6.4 billion dinars last year.

However, the primary priority remains augmenting the fund’s liquidity through financial reforms and the enactment of a debt law to establish a more sustainable financial trajectory in the medium term.

EFG Hermes projected a contraction of 0.8 percent in GDP growth for 2023 and a growth of 2.6 percent in 2024, compared to the substantial 8.2 percent growth in 2022. This is attributed to a reduction in oil production and a slowdown in private consumption growth. Kuwait adhering to OPEC+ commitments to reduce production contributed to this decline, with a decrease in oil production by an average of 3.5 percent to 2.61 million barrels per day this year.

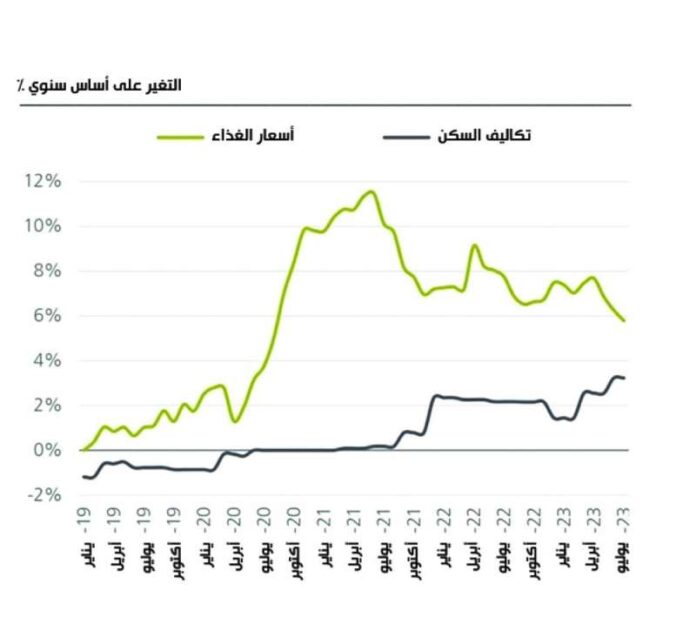

The report noted that while private consumption, a significant driver of economic growth in recent years, is likely to slow down from a high base, the trend is expected to remain positive overall. Non-oil growth is anticipated to decrease to 3.5 percent in 2024 from an estimated level of 3.8 percent in 2022.

Regarding investments, Hermes expected moderate growth in 2023 due to a 21 percent decrease in investment spending in the fiscal year 2024 budget. This decrease is influenced by considerations such as balancing current spending levels, which were relatively high due to substantial awards in the energy sector.

Despite a decline in non-oil revenues by 13 percent annually, primarily due to the conclusion of Gulf War compensation, tax revenues witnessed a significant growth of 26 percent as the economy rebounded strongly from the pandemic’s effects.

Overall, Kuwait continues to maintain a comfortable financial position, generating external assets that likely exceed $800 billion or 500 percent of the GDP, propelled by the significant increase in oil revenues and production in 2022.

Hermes emphasized that, in alignment with recent legislative changes, the Ministry of Finance was not obligated to make significant transfers to the Future Generations Fund, transferring only 1 percent of the surplus to the fund. The surplus is retained to fortify the general reserve fund. According to the IMF’s unified methodology, when investment income is factored into the budget, the fiscal surplus expands to 12.5 billion dinars, equivalent to 23 percent of GDP, showcasing the government’s robust underlying financial position.

“Hermes” expected a decline in the main financial performance this year compared to the exceptional levels witnessed last year, and the main reasons for this are due to the following:

— Oil prices returned to normal levels of approximately $100 per barrel last year.

— One-time expenditure items. Consequently, the government expects a budget deficit of 6.8 billion dinars, which Hermes believes is very conservative.

Hermes noted that in the draft budget approved by the National Assembly on August 2, the government expected a 20 percent decline in oil revenues, thanks to lower prices and oil production. She indicated that, conservatively, the government allocated $70 per barrel in its budget, which is less than $80 per barrel assumed in last year’s budget and approximately 28 percent lower than the current market price. In parallel, the government assumes that oil production will decrease by 2 percent on an annual basis to 2.68 million barrels per day.

In addition, Hermes explained that the government is planning a significant increase in spending (+12 percent year-on-year), and spending will be entirely driven by recurrent expenditures, which are scheduled to rise by 15 percent. At the same time, capital expenditures are expected to decline. By 21 percent, Hermes notes that the noticeable increase in current expenses is partly due to one-time items.

The government said that the budget includes 1.55 billion dinars in arrears and settlements, most of which are clear in the components of wages and subsidies. Excluding these one-offs, total expenditures would have increased by a more moderate rate of 5 percent.

Hermes expects the fiscal deficit to reach a relatively more moderate level of 3.7 billion dinars, as oil prices are likely to reach $80 per barrel. It also expects spending slightly less than the allocated budget.

She said the deficit should be easily financed through government reserves. On the broader financial level, that is, when considering the addition of investment income, according to the IMF’s financial presentation, “Hermes” estimates that the budget will record a total financial surplus of 2.2 billion dinars (4.5 percent of GDP), which again shows the financial position The comfortable basic that Kuwait enjoys.