MSCI plans to upgrade Kuwaiti equities to its main emerging markets index in 2020, a move that could trigger billions of dollars of inflows from passive funds. The index compiler will include the MSCI Kuwait index in the emerging market index in the May 2020 semi-annual index review.

MSCI, the world’s largest index provider, whose emerging-market group of indexes has about $1.8 trillion of assets tied to it, also said it would start a consultation on reclassifying the MSCI Iceland Index to Frontier Markets status. It said it would announce the results of this by 29 November.

Kuwait’s Market Development Project was implementing several regulatory and operational enhancements in the Kuwaiti equity market, said Sebastien Lieblich, global head of equity solutions and chairman of the MSCI Equity Index Committee.

MSCI expects Kuwait to introduce more reforms before the end of 2019, such as introducing omnibus accounts that would allow foreign investors to trade while remaining anonymous, offering the same privileges that local investors now have.

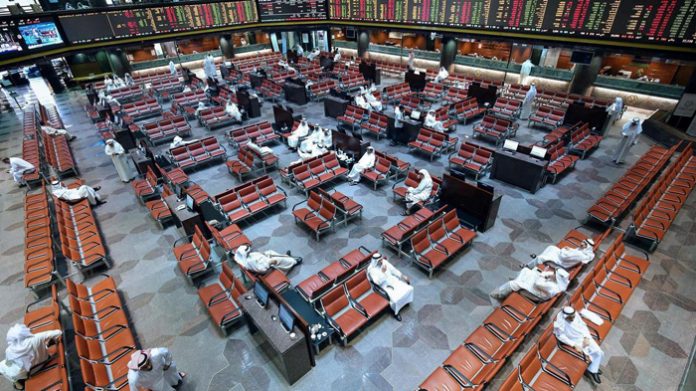

The Kuwaiti capital market regulator has announced plans for such facilities to be available to the wider market by November, Arqaam Capital said. “These enhancements have significantly increased the accessibility level of the Kuwaiti equity market for international institutional investors,” Lieblich said. The Kuwaiti market has outperformed markets in the Middle East this year in anticipation of the MSCI move.

The benchmark premier index is up about 20 percent so far this year. It was down 0.5% in early trade on Wednesday. “MSCI EM inclusion could represent the biggest ever liquidity event for Kuwait’s stock market,” said Salah Shamma, head of investment MENA at Franklin Templeton Emerging Markets Equity, adding that a 0.5 percent representation in the MSCI EM index could attract investor flows of about $10 billion.