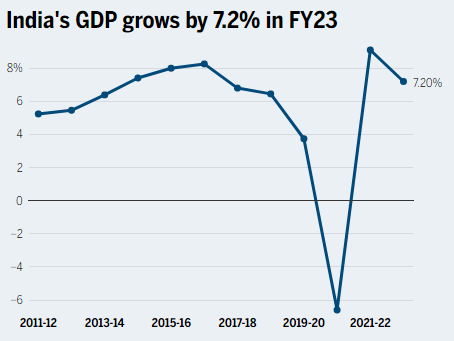

India’s gross domestic product (GDP) grew by 7.2 per cent in FY2022-23 against 9.1 per cent expansion in previous fiscal, as per the government data released on wednesday.

Despite the rate of GDP growth coming at a slightly lower rate to the previous year, India remains one of the fastest-growing economies among major global players. The GDP growth for FY2022-23 at 7.2% is higher than the 7% median estimate in a bloomberg survey as well as the government’s forecast made three months ago.

The growth propelled the Indian economy to$3.3 trillion and se the stage for achieving $5 trillion target in the next few years.

The country’s GDP grew at 6.1% in january-march 2023 the data showed.

“The higher tha expected GDP growth in Q4 FY23 is a pleasant surprise and seems to have been driven by broad based improvement in domestic drivers of private consumption, public consumption and investments. Narrowing of external trade deficit also provided comfort” economist Vivek of Quanteco Research told Reuters.

In the same period, China’s economy expanded 4.5 per cent year on year according to its National Bureau of Statistics, while Washington’s Commerce Department said the United States grew by an anaemic of 1.1 per cent.

The growth is “far in excess of the overall expectations, driven primarily by a very rich growth” in the farm and services sectors, said Rupa Rege Nitsure, chief economist at L&T

Finance. “Going by the high frequency indicators, this slowdown has primarily come from urban rather than rural belts. Improved farm sector conditions will help reduce the adverse impact of El Nino predicted for this year,” she added.

Services have emerged as a major driver of the economy, comprising more than half of the nation’s GDP. India has been gaining market share in information technology and business consulting work, boosting services activity to the highest in almost 13 years.

GDP growth gives RBI room to pause key rates India’s resilient growth could reassure the Reserve Bank of India that its monetary tightening hasn’t taken a big toll on the economy and give it more room to pause for a second straight meeting on June 8. This is an outcome predicted by economists in a Bloomberg survey which sees rates on hold for the rest of the year before RBI starts lowering borrowing costs in 2024. The benchmark repo rate is currently at 6.5%

Key numbers from the GDP report:

- Agriculture rose 4%, mining was up 4.6%, manufacturing

increased 1.3% last fiscal year - Electricity +9%; construction +10%; trade, hotels and

transport +14%; - Financial services +7.1%; public administration +7.2%

- Government spending rose marginally 0.12%, consumption

was up 7.5% - Gross fixed capital formation, a proxy for investment,

increased 11.4% - Gross value added, a key measure of economic productivity,

rose 6.5% in January-March from a year ago

Source: TOI