India recently overtook UK as the world’s fifth biggest economy – and it could be third by 2030

The rise of China has been the biggest story in the global economy in recent decades. But amid concern about its stumbling property market and global fears about inflation, the emergence of its neighbour, India, as a potential new economic superpower may be going under the radar.

You won’t find mention of it in Liz Truss’s blueprint for a “modern brilliant Britain”, but the UK has just been overtaken by India as the world’s fifth biggest economy. The nation of 1.4 billion people is on track to move into third place behind the US and China by 2030, according to economists.

And while the world became familiar with Chinese business titans such as Alibaba founder Jack Ma, the staggering wealth accumulated in recent years by Indian billionaires Gautam Adani and Mukesh Ambani has been less well publicised.

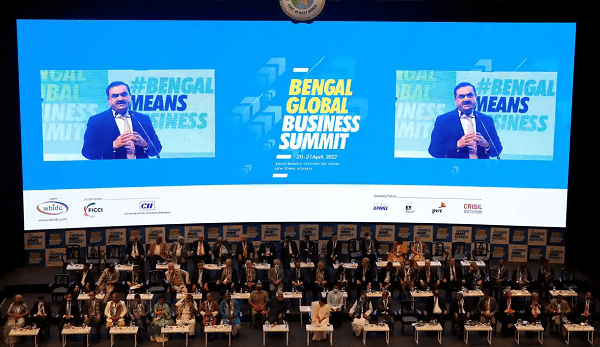

Adani, in particular, has come to represent India’s growing economic strength thanks to the rapid expansion of his Adani Group conglomerate, which covers everything from ports to airports, and solar power to television. Having entered the global Top 10 when he became Asia’s richest person in February, he is now ranked third with a fortune of $143bn (£123bn) and is closing fast on second-placed Amazon boss Jeff Bezos.

India was for many years seen as the poor relation to China, held back by a sclerotic, sprawling state sector and labyrinthine bureaucracy. It still has enormous problems of poverty and poor infrastructure, but it is beginning to emerge as a rival to its large neighbour with the kind of economic growth figures that were once the pride of Beijing.

Gross domestic product (GDP) grew by 13.8% in the second quarter of this year as pandemic controls were lifted and manufacturing and services boomed. Although double-digit growth is unlikely to be repeated in subsequent quarters, India is still on track to expand by 7% this year as it benefits from economic liberalisation in the private sector, a rapidly growing working population, and the realignment of global supply chains away from China.

“India has overtaken the UK to become the world’s fifth-largest economy,” says Shilan Shah, senior India economist at the consultancy Capital Economics, citing recent updated figures from the International Monetary Fund. “Looking ahead, India looks set to continue its march up the global rankings. In all, we think India will overtake Germany and Japan to become the third-largest economy in the world within the next decade.”

A key part of India’s continued rise will be its ability to grow its manufacturing sector and challenge China as the world’s No 1 exporter. India has already benefited from a large, well-educated, often English-speaking middle-class, helping the country to develop world-class IT and pharmaceutical sectors. It also has strong consumer demand, which accounts for about 55% of the economy compared with less than 40% in China.

Now the trick will be to benefit from its youthful working population to position itself as a manufacturing power to rival China, where an ageing labour force and rising pay levels are reducing its competitive edge. With a geopolitical wedge opening up between China and the west, India also has the opportunity to grow in reshaped international supply chains.

Nguyen Trinh, emerging markets economist at Natixis bank in Hong Kong, says the outlook is promising for India if it can keep investing.

“Indian demand is expected to be strong due to its demographics,” she says, “which is rather favourable with rising working-age population that will push for demand for essentials such as food and energy as well as infrastructure investment. The normalisation of activities post-Covid as well as an increase in government spending, particularly in infrastructure investment, is helping growth. Consumption rose in double digits and investment is accelerating.”

As with many aspects of India’s economic rise, Adani’s story is instructive. Now 60, the billionaire dropped out of Gujarat University, moved to Mumbai, and began trading diamonds before expanding into ports, construction and – latterly, but very profitably – renewable energy.

These widespread industrial interests have dovetailed perfectly with the country’s thirst for growth and seen his Adani Group holdings on the Indian stock market rocket in value. His main listed company, Adani Enterprises, has grown 50-fold in value in the past five years, while Adani Green Energy, which looks after its push into solar power, has doubled in value in the past year. The group is ploughing $70bn into green energy projects by 2030 with the aim of becoming the world’s largest renewable-energy producer – ironic given the controversy over its plans to expand coal mining in Australia.

Another important symmetry comes from Adani’s origins in the western state of Gujarat, which is also the power base of the Indian prime minister, Narendra Modi. Modi’s market reforms, which have included cutting corporation tax from 35% to 25% and opening up India to more foreign investment, have freed up entrepreneurs such as Adani and the man he overtook as the country’s richest person, Mukesh Ambani, head of Reliance Industries, and another Gujarati. Adani is close to Modi who has been known to use the tycoon’s private jet for campaign trips.

Nowhere is the local and global ambition of Adani more clearly illustrated than in Mundra, the Arabian Sea port which he wants to become the world’s largest by the end of the decade. With Modi’s government rolling out a 100tn rupees ($1.35tn, £1.1tn) infrastructure programme – it aims to build 25,000km of new roads in the current financial year alone – Adani is well placed to profit at every stage as the necessary raw materials are shipped in, turned into goods and services, and then sent back out around the world through Mundra.

Source: The Guardian