PUBLISHED IN COOPERATION WITH

In the digitalized financial world even the word disruption has adopted a wholly positive meaning.

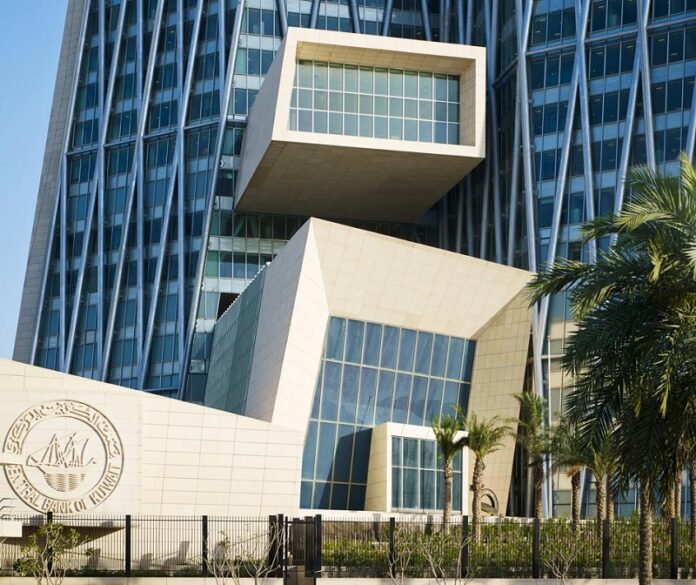

It must be asked: What are digital solutions and financial fluency, and the fintechs behind them, actually disrupting? Perennial financial exclusion among individuals, and bureaucratic obstacles that dam up swift investment decisions and further innovation. Not to mention potential loss of revenues that could be sitting in state coffers. In a recent The Business Year (TBY) interview, Central Bank of Kuwait (CBK) Governor Basel A. Al-Haroon notes that “at the end of 2Q-2022, [Kuwait’s banking] sector remains well capitalized with a CAR of 18.4 percent. Moreover, “on a consolidated basis, total assets grew by 8.8 percent in 2Q2022 in annual terms.” Digitalization, therefore, reflects the global tendency toward still greater efficiencies.

Digital Watch: Galvanizing the knowledge economy is essential to the Kuwait Vision 2035 goal of a sustainably diversified economy liberated from dependence on hydrocarbon exports, a necessity merely underlined by the pandemic. “The objective,” says Al-Haroon, “is to make processes faster, cheaper, and more efficient without compromising security or privacy.” To this end, “CBK has adopted technology and upgraded its capabilities with a 360-degree view of regulated units, end-to-end paperless processes, insights informed by targeted analytics, future-proof technology at the heart of the new digital foundation, and best in-class capabilities within a solid structure.” This built-in readiness ensures that digital adoption is pragmatic, rather than adventurist.

Setting the Pace: In early 2022 — a hugely prolific year on the digital front — CBK released fresh guidelines for establishing digital banks. The digital banking framework to enable and support new entities was based on a study of how 25 other central banks had tackled the subject. Accordingly, digital banks were divided into three key models. First, a unit within a traditional bank. Second, a partnership between a bank and a digital institution where the bank performs core banking operations while the other party undertakes customer relations, trademark, and other service areas. The third model involves a standalone digital bank. CBK welcomed the added value that the digital banking route promises to deliver to the consumer and broader economy. It then required all completed application forms and documentation as of the date of issue of the guidelines by 30 June, 2022. Initial approval was then to be given by year-end.

Castles in the Sand…: Incidentally, in August of this year, CBK took the major innovative step by testing an open banking product within Kuwait’s pioneering regulatory sandbox, with the participation of voluntary customers. The sandbox, of course, provides the opportunity to iron out any kinks that could be costly to banking system integrity post roll-out. The sandbox was launched in 2018, its scope being expanded a year later.

Practical Portal: Two months earlier, CBK also announced it would gradually roll out an advanced banking sector digital portal to improve internal system mechanics. The portal, part of the country’s overarching digitalization program, works to expedite request processing between CBK and the sector while expanding service offerings. The initial phase was to deliver a series of e-services to slash paper-based requests, establish a pre-set time frame to completion, gee-up operational processes, and improve decision-making capabilities.

Capital Markets Claim Their Share: Kuwait’s financial markets overall are riding the digitalization bandwagon, with patent success. Also in August, Kuwait’s Capital Markets Authority joined the ranks of the Global Financial Innovation Network (GIFN). The international network champions financial innovation while acting as a regulatory mechanism for emerging technology.

In July 2022, World Finance magazine named Kuwait’s stock exchange, Boursa Kuwait, the “Most Sustainable Company in the Financial Services Industry.” The accolade acknowledged initiatives to generate awareness and adoption of sustainable business practices, internally and among wider capital markets. The exchange is vocal about its corporate sustainability (CS) strategy, having joined the UN’s Sustainable Stock Exchange (SSE) initiative in 2017.

A Share of Social Awareness: In keeping with its commitment to the support and promotion of responsible, sustainable, and impactful business practices, Boursa Kuwait also partnered with the UN’s Development Program (UNDP) in conducting a workshop addressing the standards, practices and tools required for the implementation and reporting of environmental, social, and governance (ESG) principles.

On the occasion, the marketing and communications senior director at Boursa Kuwait emphasized the need to inculcate an awareness of those principles among market participants and pursue sustainable business operations and practices that foster greater operational efficiency and realize corporate objectives. In Kuwait’s financial markets, then, the wheels of digitalization are not merely in motion, but doing so on carefully monitored tracks.