Kuwait banks eager to finance mega projects

Despite the turbulent economic conditions and geopolitical tensions that have characterized global markets, Kuwait’s banking sector has continued to deliver exceptional performance and record-breaking profits, reaching an unprecedented high in 2023. Kuwaiti banks have successfully maximized their profitability, increasing it from approximately KD 488.1 million in 2013 to more than KD 1.5 billion by the end of last year, representing a remarkable growth of 214.5%.

As financial results for 2023 indicate the continued strength of the banks’ performance, supported by a stable operating environment and the prudence of the Central Bank of Kuwait, bankers and experts have told Al Qabas that the banking sector is experiencing a surplus of excess liquidity, while the country is suffering from a shortage of new projects and a decline in investment spending.

Excess liquidity seeks investment outlets

Eissam Al-Saqr, CEO of Kuwait National Bank Group, stated, “Banks rely heavily on large projects in all economic sectors. In recent times, banks have faced a shortage of projects, leading to an increase in liquidity. This is due to a lack of long-term vision.” He added, “Historically, Kuwaiti banks have played a key role in financing large projects when there was a clear vision. The absence of this vision is causing concern for the sector.”

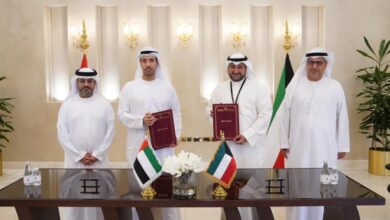

For his part, Abdulwahab Al-Rashoud, acting CEO of KFH Group, affirmed, “The banks’ ability to compete in financing development projects in the Gulf and the region, given their high surpluses, strong capital standards, solid creditworthiness, and strong and diversified portfolios.” He pointed out that “banks have participated in many cross-border financing deals and have proven their ability to lead large-scale financing.”

Economist Jassim Al-Saadoun said, “The reason for the surplus of liquidity in the banking sector is due to the weakness of local economic activity and the high risks of directing it abroad. Local development projects are almost at a standstill, and real estate asset prices, and to some extent financial ones, are high, which reflects the limited investment opportunities. This means that banks’ sources of income, lending, and investment are weak. However, a reading of their financial data suggests that their margins continue to favor continued performance growth.”

For his part, Sheikh Ahmed Al-Duaij, Chairman of the Kuwait Banks’ Association and Chairman of the Commercial Bank of Kuwait, said, “Kuwaiti banks enjoy large amounts of liquidity as a result of the increase in the volume of deposits with a shortage of investment channels.” He stressed that they are in a strong position to finance major strategic projects in the region, given their strong financial structure and extensive experience in project financing.

Economist Ali Rashid Al-Badr stated, “Kuwait has a strong banking sector despite the difficult operating environment and various geopolitical conditions. This is generally due to the increase in total operating income and the decrease in provisions due to the improvement in asset quality and the decline in non-performing loan ratios to levels that are considered among the best in the world.”