S&P expects robust government support for Kuwait’s banks

The credit rating agency reported that Gulf outflows could reach $221 billion, accounting for 30% of the external liabilities of the 45 largest banks in the region.

• Under S&P’s asset quality deterioration scenarios, 13 of the top 45 banks in the Gulf region could face losses in the high-pressure scenario, based on the net annual revenues disclosed as of June 30.

S&P, the American credit rating agency, has warned that the recent escalation of the war in the Middle East has heightened the risk of broader regional fallout, potentially impacting the creditworthiness of both sovereigns and banks, Al Rai newspaper reported.

Accordingly, the agency developed four stress scenarios to assess how risks may evolve and impact banks in the Gulf countries. S&P believes these risks could manifest in the following ways:

- Non-resident foreign investors withdrawing their money from the Gulf region as risks increase.

- The outflow of domestic funding, although this is expected to occur only under conditions of heightened tension, as seen during the Gulf War in 1990-1991.

- A sharp rise in default rates among corporate and individual bank customers due to the impact of geopolitical instability on regional economies.

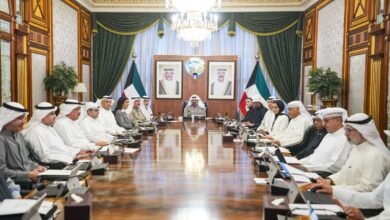

The agency believes that the governments of Kuwait, Qatar, Saudi Arabia, and the United Arab Emirates (UAE) are highly supportive of their banking systems. As a result, S&P expects banks in these countries to receive exceptional government support if needed.

To assess potential risks, S&P analyzed data on domestic and external financing sources provided by central banks as of June 30, 2024, along with asset quality data disclosed by the 45 largest banks in the Gulf region. Based on their consolidated assumptions, outflows from the region could total approximately $221 billion, representing about 30% of the cumulative external liabilities of these banking systems.

However, the agency believes that most banks have sufficient external liquidity to manage such outflows. In the extreme stress scenario, S&P anticipates a withdrawal of $275 billion from domestic private sector deposits. Nevertheless, it expects banks to be able to handle this situation due to their liquid assets and potential central bank support, if necessary.

Under S&P’s asset quality deterioration scenarios, thirteenof the top 45 banks in the Gulf region could face losses in the high-pressure scenario, based on the net annual revenues disclosed as of June 30, 2024. This number could rise to 25 banks in the extreme pressure scenario, with cumulative losses reaching $24.6 billion.