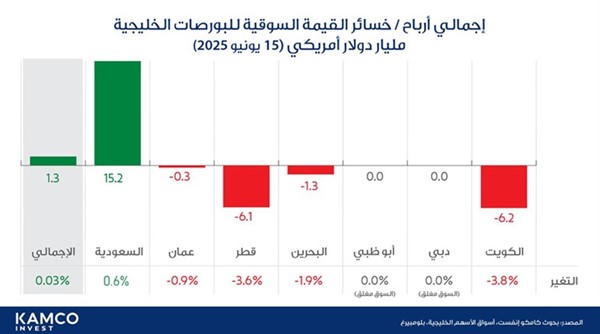

The Saudi stock market staged a strong recovery on Sunday, gaining $15.2 billion in capitalization and reversing the heavy losses recorded across Gulf markets last Thursday.

The gain shifted the overall performance of the five Gulf exchanges that traded on Sunday into positive territory, with net gains reaching $1.3 billion — a 0.03% increase — despite continued sharp declines in four other markets, reports Al-Anba daily.

This rebound came amid heightened geopolitical tensions in the region, particularly the intensifying conflict between Iran and Israel. Investor sentiment has been shaken by fears over energy security and the possibility of broader regional instability, prompting a wave of sell-offs in most Gulf markets.

Kamco Invest data shows, the combined losses of the four declining exchanges on Sunday amounted to $13.9 billion.

The Kuwait Stock Exchange recorded the largest drop in market capitalization, shedding $6.2 billion, a decline of 3.8%. Qatar followed with a $6.1 billion loss (3.6%), Bahrain with $1.3 billion (1.9%), and Amman with $300 million (0.9%).

In Kuwait, the market experienced a turbulent session, losing 1.87 billion dinars in value. The total market capitalization dropped to 46.85 billion dinars, down from 48.72 billion dinars at the end of last week.

Trading was suspended for 15 minutes after the Premier Market Index plunged more than 5% at the opening.

By the end of the session, the Premier Market Index closed 3.9% lower, falling 348 points to 8,507. The Main Market Index dropped 3.3% to 6,736, while the General Index ended 3.8% lower at 7,843.

Despite the overall decline, market liquidity increased by 13%, reaching 127.6 million dinars compared to 112.8 million dinars in the previous session.

Five stocks accounted for 54.2% of total trading value: Kuwait Finance House led with 34.5 million dinars in trades, followed by the National Bank with 10.1 million dinars, Warba Bank with 9.6 million dinars, International Bank with 8.5 million dinars, and Boubyan Bank with 6.5 million dinars.

Trading volume also saw a 5% increase, with 446 million shares exchanged. KFH was the most traded stock with 47.4 million shares, followed by Warba with 40.3 million and International Bank with 35.5 million shares.

Sector-wise, all segments declined except healthcare. Consumer goods stocks suffered the steepest losses at 7%, followed by technology at 6.7%. Of the 131 listed companies, 119 saw declines in share prices, only 9 recorded gains, and 3 remained unchanged.

The Saudi market’s performance stands in contrast to Thursday’s widespread declines across the Gulf, when regional exchanges lost approximately $29.4 billion in total capitalization.

Saudi Arabia alone had lost $12.7 billion (-0.5%), while Abu Dhabi dropped $7.5 billion (-0.9%), Dubai declined $5.4 billion (-2.1%), Kuwait shed $2.2 billion (-1.4%), and Qatar lost $1.3 billion (-0.7%). The Amman and Bahrain exchanges lost $200 million (-0.5%) and $100 million (-0.2%) respectively.

Analysts warn that investor caution will likely persist, as the threat of the conflict spreading to strategic areas such as Yemen or key maritime routes could disrupt global energy supplies and spark a new energy crisis, adding further pressure on global and regional markets.