-

Kuwaiti banks, thriving in a stable market are poised for growth with the upcoming mortgage law reforms.

-

Kuwaiti government’s focus on economic diversification, regulatory reforms, and mega projects is fostering a more dynamic business environment.

-

Kuwaiti banks are well-positioned to sustain profitability, supported by the country’s strong projects market.

Kuwait’s banking sector is on the brink of transformation, fueled by rapid economic expansion, intensifying competition, and sweeping structural reforms set to redefine the industry landscape.

According to The Banker, while Kuwaiti banks have historically thrived in a stable and well-regulated market, upcoming reforms, especially the long-anticipated mortgage law, could open new lending avenues despite mounting competition and an uncertain interest rate landscape that threatens profitability.

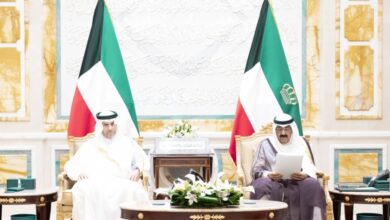

The National Bank of Kuwait’s Deputy CEO, Sulaiman Al-Marzouq, stated that the government’s emphasis on economic diversification, regulatory reforms, and the acceleration of mega projects is creating a more dynamic business environment.

Al-Marzouq added that Kuwaiti banks showed resilience in 2024 despite a challenging economic environment marked by weak non-oil growth, contractionary fiscal policies, and a 7% decline in crude oil production due to OPEC+ production cuts.

Financial Regulation

The Banker highlighted that in recent years, Kuwait’s ten local banks have set themselves apart from their Gulf counterparts by maintaining slower yet steady growth, avoiding sharp performance fluctuations due to a well-protected market, prudent financial regulations, and diversified operations.

This resilience has enabled most Kuwaiti banks to withstand consecutive contractions in the energy-dependent domestic economy, shrinking by 3.6% in 2023 and 2.7% in 2024, according to the International Monetary Fund, while continuing to achieve steady growth in both profits and assets.

Most major Kuwaiti banks reported strong net profits for 2024. Looking ahead, bankers anticipate a transforming domestic landscape, with economic growth expected to accelerate to 3.1% in 2025, according to Fitch Ratings, mirroring a broader growth trend across the Gulf.

Boost Returns

Khaled Yousef Al-Shamlan, Group CEO of Kuwait Finance House, emphasized that the ongoing economic recovery will bolster both Kuwait Finance House and the broader banking sector. He added that this growth is expected to expand financing portfolios and enhance returns, with favorable discount rate movements further stimulating financing activities.

Al-Shamlan noted that while the details of the new mortgage law have yet to be officially announced, it is clear that the legislation is crucial for strengthening the real estate sector, particularly private housing. He emphasized that once finalized; the law will have a positive impact on both Kuwait Finance House and the broader banking sector.

The Banker report highlighted that Kuwait’s banks are closely monitoring the government’s upcoming structural reforms, recognizing their potential impact on the financial sector.

A Qualitative Leap

Fitch Ratings’ Gilbert Hobeika stated that if the mortgage law is passed, it will be a game changer. Credit growth could exceed 10%. He emphasized that the financing and liquidity law would introduce a new market dynamic, enabling the government to accelerate projects and initiate more developments.

Hobeika added that it will also help boost banks’ liquidity, as holding government bonds on the asset side means owning a highly liquid instrument. This will ease pressure on banks to meet regulatory liquidity requirements and support capital, as government instruments carry a zero risk weight.

Maintaining Profitability Levels

Experts believe that this surge in activity will drive domestic lending for Kuwaiti banks in 2025, while also helping to maintain stable profitability levels.

Junaid Ansari, Director of Investment Strategy and Research at Kamco Invest, stated that Kuwaiti banks are comfortably positioned to maintain current profitability levels given the country’s robust projects market. However, he cautioned that any potential increase in profitability could be affected by interest rate volatility, intense local competition, and high regulatory provisioning requirements, despite favorable conditions.

Source: Al Qabas