Local bank lending for securities soars to nearly one billion dinars

Lending operations by local banks for investing in securities have witnessed a 57.5 percent increase since the beginning of the year.

-

Securities investment financing rose alongside a 3% increase in new credit facilities, from KD 11.708 billion to KD 12.067 billion, in the first half of 2024.

-

The flexibility banks show clients in financing share purchases indicates the strength of certain listed companies and investment targets.

-

The cash credit facilities declined by 4.2 percent, or KD 2.25 billion, in the first half of 2024, falling from KD 55.8 billion in December to KD 53.557 billion at the end of June.

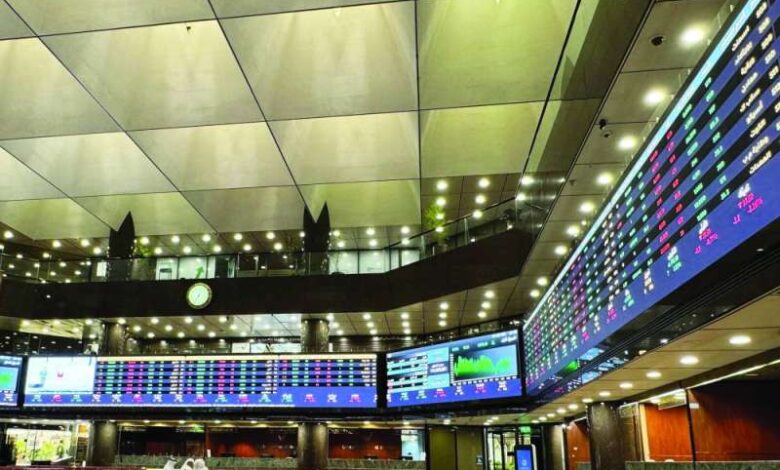

Lending operations by local banks for investing in securities—such as purchasing shares on the Kuwait Stock Exchange, bonds, and sukuk—have surged since the beginning of the year. By the end of July, these operations had reached nearly one billion dinars, marking a 57.5 percent increase from KD 634 million during the same period in 2023, according to Al Rai newspaper.

This is according to official data, which show an average monthly facility of nearly KD 142 million. Facilities for the first half of this year totaled KD 861.3 million, a 57.4 percent increase over the same period in 2023.

The rise in securities investment financing coincides with a significant three percent increase in new credit facilities provided to all permitted sectors during the first six months of 2024, climbing from KD 11.708 billion to KD 12.067 billion.

Strengthening financial positions

The flexibility banks show clients in financing share purchases indicates the strength of certain listed companies and investment targets. This flexibility reflects the characteristics of these entities and their potential for receiving financing.

Companies and listed entities that follow strategic plans to strengthen their financial positions through procedures, allocations, and reserves are more likely to ensure their continuity and create a secure environment, which enhances confidence in them.

Estimated percentages to fund share purchases

The Central Bank of Kuwait established estimated percentages for financing share purchases following the global financial crisis of late 2008. However, the solid financial positions of several companies and banks have led to an increase in these percentages, provided that a set of financial requirements and data is met by customers.

Local banks provided substantial amounts of money for purchasing securities, most of which are listed on the stock exchange. It was noted that this additional liquidity was primarily directed towards bank shares and a group of listed financial service and real estate companies.

The operations included executing special deals involving quantities that represent strategic positions in these companies, with some funds used to support the ownership and main positions of institutions and companies. Individuals also benefited from these facilities.

The guarantees for these facilities included ownership in operating entities, such as shares in companies, as well as real estate and other assets that could be liquidated if necessary. The growing trend of credit facilities directed towards stock investments suggests that the stock exchange is on track to solidify its role as a key investment vehicle and a primary choice for both local and foreign capital investors.

In the same context, the accumulated balance of securities financing at local banks increased by 4.1 percent, or KD 142.9 million, on a monthly basis, rising from KD 3.488 billion in May to KD 3.631 billion in June.

Local banks adopt a strict and cautious approach to financing securities, which has led them to not fully utilize the percentages permitted by the regulator for purchasing listed shares. This caution stems from concerns about increasing their exposure to shares and repeating the issues experienced after the financial crisis, as well as from certain practices by companies, institutions, and individuals in using this financing.

Balance of cash credit facilities

According to Central Bank data, the total balance of cash credit facilities provided by banks (to all sectors) declined by 4.2 percent, or KD 2.25 billion, during the first six months of 2024, falling from KD 55.8 billion in December to KD 53.557 billion at the end of June.

However, this balance increased on a monthly basis by 0.9 percent, or about KD 510.7 million, rising from KD 55.297 billion at the end of May. On an annual basis, it grew by about KD 2.82 billion, up from KD 52.98 billion in June 2023.