Kuwait: The GCC’s Quiet Digital Disruptor

Kuwait is emerging as a digital powerhouse in the Gulf, albeit with far less fanfare than some of its neighbors. Long known for its oil wealth, the country is now investing heavily in technology, digital infrastructure, and human capital to transform its economy for the 21st century. This op-ed examines how Kuwait’s strategic investments, forward-looking government agenda, and young tech-savvy population are quietly but steadily turning the nation into a regional leader in digital innovation.

By Sarah Al Sabah

Special to The Times Kuwait

Strategic Investments and Vision:

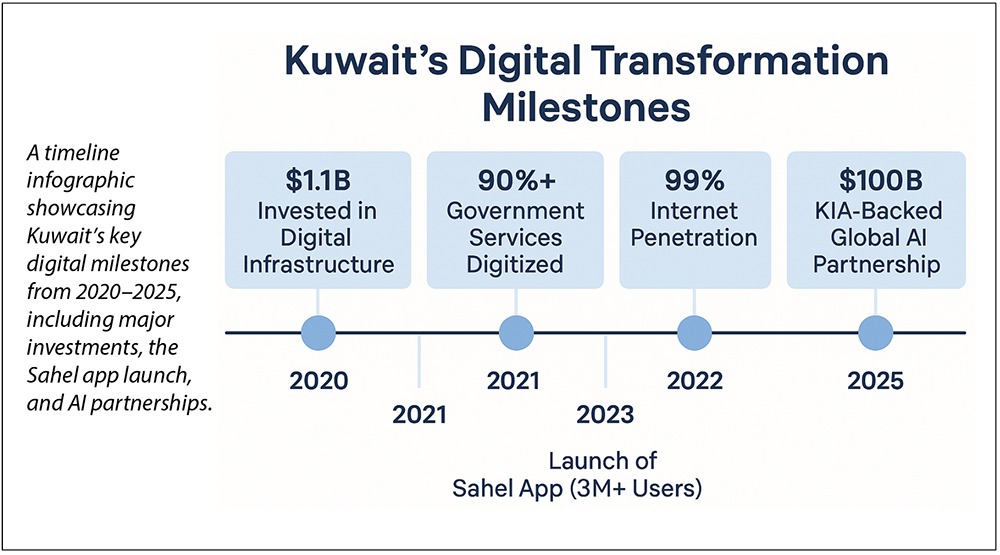

US$1.1 billion for Digital Infrastructure: Kuwait’s recent budgets have earmarked roughly $1.1 billion for digital infrastructure projects: from smart city developments to broadband networks and next-gen connectivity. These investments signal a serious commitment to building the backbone of a digital economy. Crucially, they are backed by the Kuwait Investment Authority (KIA): the sovereign wealth fund that manages an estimated $1.1 trillion in assets, ensuring ample financing for the country’s high-tech ambitions. KIA has not only financed local initiatives but also partnered with global tech players (such as Microsoft, BlackRock, and others) to develop AI infrastructure on a worldwide scale. This alignment of fiscal might with tech development underscores Kuwait’s drive to shift from heavy oil dependency to the new frontier of growth, algorithms.

Vision 2040 and New Kuwait 2035: Kuwait’s digital agenda is guided by long-term national strategies. Kuwait Vision 2040 and the New Kuwait 2035 plan are blueprints that place economic diversification, e-government, and a knowledge-based economy at the forefront of policy. All major digital initiatives are funneled toward these goals, creating a unified roadmap for transformation. The government’s partnership with Microsoft in 2025 to establish new AI cloud centers aligns with Vision 2035’s focus on innovation and governance reform. In short, Kuwait’s leadership has articulated a clear narrative: invest today in digital capacity to ensure prosperity and sustainability tomorrow.

KIA as a Tech Enabler: The Kuwait Investment Authority has become a key enabler of this vision. Already one of the world’s largest sovereign funds, KIA is leveraging its global clout to support Kuwait’s digital transformation. It recently joined an international AI Infrastructure Partnership aimed at mobilizing up to $100 billion for next-generation AI and cloud computing investments. By infusing capital and confidence into tech ventures at home and abroad, KIA is effectively underwriting Kuwait’s journey “from hydrocarbons to high-performance compute,” as one industry strategist observed. The message is clear: Kuwait’s financial firepower is now firmly behind its digital future.

Digital Infrastructure and Connectivity:

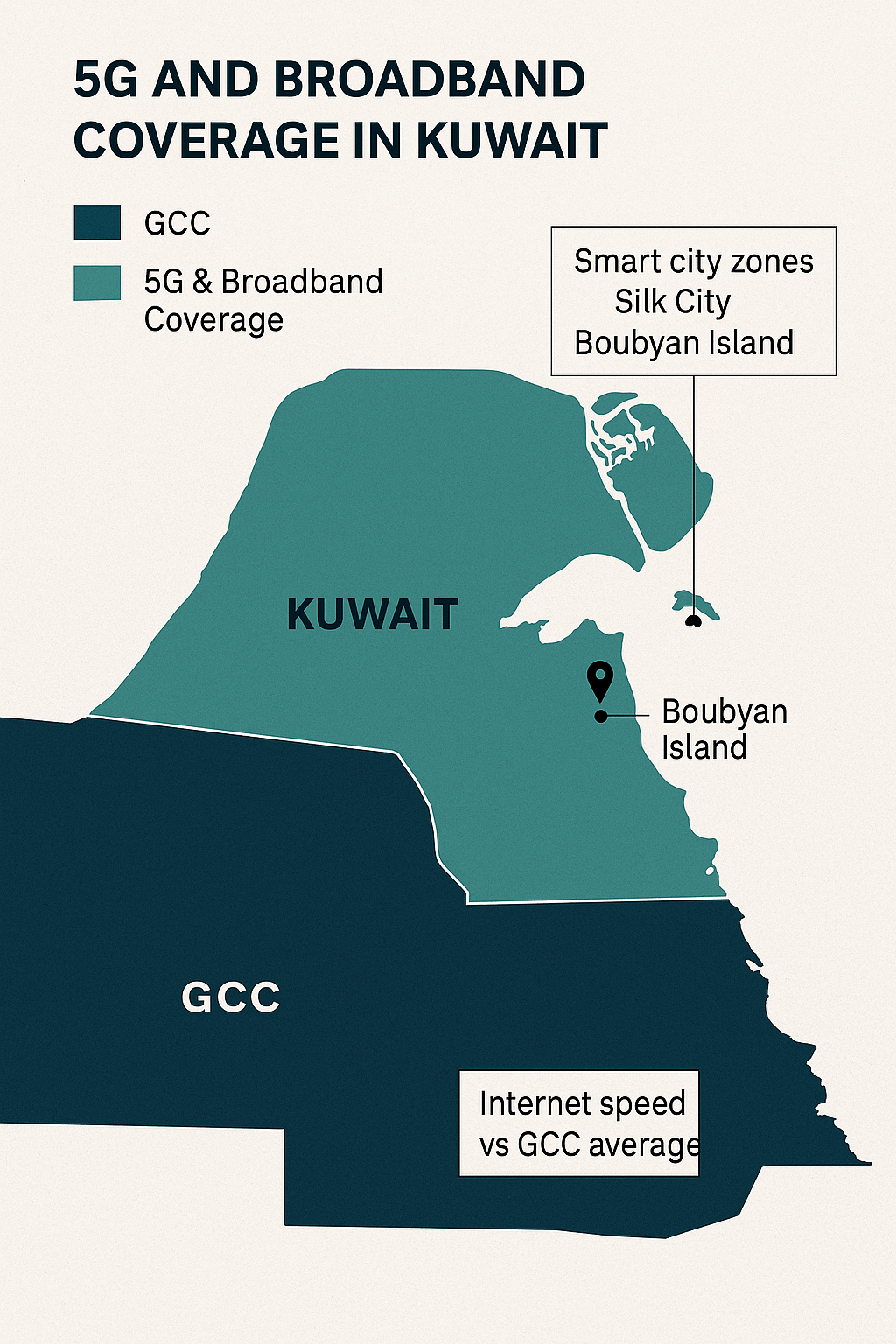

Nationwide Internet and 5G Coverage: Kuwait today boasts near universal internet access and advanced mobile networks. Home internet penetration is 99.4 percent and 5G coverage reaches about 97 percent of the population, placing Kuwait among the top tier of GCC countries in digital connectivity. The country’s telecom sector is already trialing 6G technologies and expanding fiber-optic broadband and satellite links to ensure every community is connected. In practical terms, this means Kuwait’s citizens and businesses enjoy some of the fastest internet speeds and most reliable digital access in the region, A critical foundation for everything from e-government to fintech.

‘Smart Kuwait’ Urban Vision: Digital infrastructure development in Kuwait goes hand in hand with ambitious urban planning. The government’s Smart Kuwait initiative envisions seamlessly integrating technology into new city projects and public services. Plans for Silk City and Boubyan Island, massive developments in the works, include smart city frameworks leveraging IoT sensors, AI, and big data for sustainable urban living . The aim is to coordinate public and private efforts so that smart infrastructure (traffic systems, utilities, public safety, etc.) evolves in tandem with digital government platforms. By aligning its digital blueprint with physical development, Kuwait is future-proofing its cities to be both high-tech and highly livable.

National Broadband Network: A robust national broadband network is being rolled out to connect homes, small businesses, and government institutions on a single fiber backbone. High-speed fiber-to-the-home and fiber-to-the-office projects are well underway, extending affordable high-bandwidth access across the country. This inclusive connectivity drive ensures that not only urban centers, but also smaller municipalities benefit from the digital economy. Early evidence shows that widespread broadband is boosting e-commerce activity, digital education, and ICT growth for SMEs. The outcome is that widespread broadband access contributes directly to Kuwait’s economic diversification. In short, the foundations are laid for a truly nationwide digital ecosystem.

Government and Public E-Services:

E-Government Transformation: Few Gulf states can rival Kuwait in the quiet efficiency of its e-government rollout. As of 2025, over 90 percent of government services are available in digital form. Whether via web portals or mobile apps. This aggressive digitization has slashed bureaucracy and wait times for citizens and residents. Need to renew a license, pay a fee, or request a permit? It can likely be done online in minutes, with minimal human interaction. The COVID-19 pandemic further accelerated this transition, and Kuwait’s public sector largely succeeded in moving workflows online, saving millions of paperwork transactions. The government continues to work towards an official target of fully digitizing services (over 90%) in the coming few years.

Sahel Unified App: A cornerstone of Kuwait’s e-government strategy is the ‘Sahel’ app, a unified mobile platform that brings together services from dozens of agencies. Launched in 2021, Sahel quickly gained traction; it has now been adopted by over three million users who can access over 450 services through a single login. Through Sahel, a citizen can receive government notifications, renew their civil ID, pay bills, make medical appointments, and more. All in one place. The app’s success is evident: more than 100 million government e-transactions have been processed via Sahel as of this year, reflecting huge time and cost savings for the public. Officials are continually adding new features and even an English version to serve expatriates, pushing Kuwait’s digital government toward greater inclusivity and convenience.

Digital IDs and E-Signatures: Kuwait has implemented a fully integrated Digital Civil ID system, which is now accepted across both public and private sectors. The country’s Public Authority for Civil Information (PACI) provides a mobile ID app that serves as a secure digital identity and enables verified e-signatures. From opening bank accounts to accessing healthcare or signing legal documents, Kuwaitis can use their digital ID instead of physical cards. The secure e-ID system, developed with global tech partners like Thales, has laid the groundwork for widespread e-commerce and remote services by ensuring trust and authentication. This digital identity initiative exemplifies how Kuwait is merging technology with governance reforms to improve service delivery.

AI in Public Services: The government is also deploying artificial intelligence to make public services smarter and more efficient. AI tools are being used in Kuwait’s customs service to enhance border security and automate inspections, in the judiciary to assist with case management, and in the labor ministry to streamline work permit processes. For example, predictive analytics and machine learning help flag suspicious shipments at customs, improving contraband detection, while AI chatbots guide users through e-government portals. These early forays into AI for public good are improving transparency and cutting red tape. Kuwait is even experimenting with AI-driven traffic management and smart utility grids under its Smart Kuwait vision. Over a dozen government entities have piloted AI or big-data projects in the last two years. A number poised to grow as the tech matures.

Talent and Workforce Development:

Youthful Demographics: Kuwait’s digital rise is powered by its people. Notably a young, tech-savvy population. Roughly 70 percent of Kuwait’s residents are under the age of 35, a demographic structure that naturally embraces new technology and innovation. This youth creates strong demand for digital services and provides a large talent pool for the tech industry. The government sees its young human capital as a strategic asset: a new generation that can pivot from oil-era jobs into ICT, startups, and knowledge economy roles. As one observer noted, Kuwait is “betting on…a young talent base” as it repositions for the post-oil era.

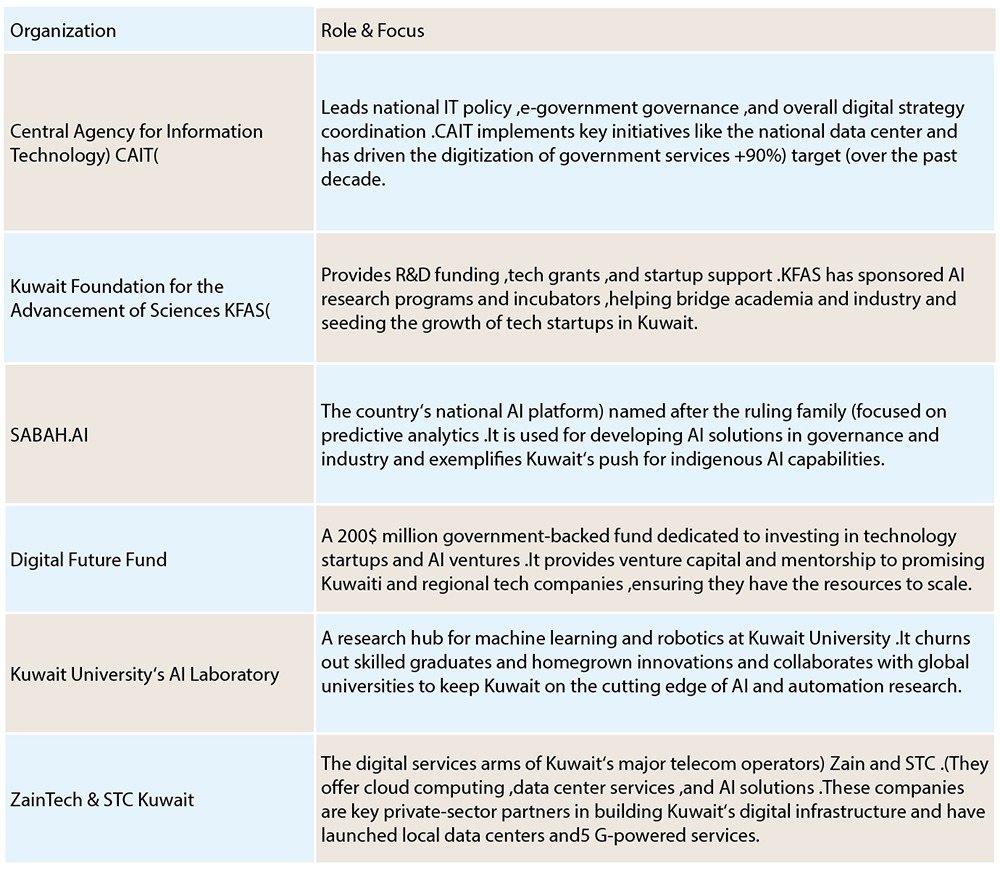

National Upskilling Initiatives: To harness this talent, Kuwait has launched aggressive training and upskilling programs. The Central Agency for Information Technology (CAIT) and partners train thousands of Kuwaitis annually in digital skills like AI, cybersecurity, cloud computing, and coding. In the span of just 2020–2021, CAIT trained over 4,000 government employees in IT and ran digital leadership workshops for dozens of public-sector leaders. This effort has only expanded. Current initiatives like the National Digital Transformation Academy aim to train 5,000+ Kuwaitis each year in emerging tech fields. The private sector is pitching in as well: tech majors like Microsoft, Huawei, and Amazon Web Services have all sponsored training programs or academies in Kuwait to build local expertise. The clear goal is to fill the digital skills gap and ensure Kuwaiti youth can compete in, and lead, the new economy.

Academic and R&D Leadership: Kuwait’s universities and research institutions are also stepping up in the digital realm. Kuwait University has established an AI and Robotics lab that is conducting research on machine learning applications, often in collaboration with international partners. Meanwhile the Kuwait Foundation for the Advancement of Sciences (KFAS) is funding research grants and incubators for AI, renewable energy tech, and other innovations.

KFAS has been at the forefront of supporting local startups and even runs programs to bring cutting-edge tech education (like AI and data science bootcamps) to Kuwaiti students and professionals. Such efforts are cultivating a homegrown research community that can adapt global technologies to local needs. The presence of these knowledge institutions ensures Kuwait’s digital push is grounded in local capacity-building and not just imported expertise. Over time, this will help drive a sustainable, innovation-driven economy.

Fintech and the Digital Economy:

Regulatory Innovation (Open Banking): Kuwait’s financial regulators are embracing innovation to make the country a fintech-friendly hub. The Central Bank of Kuwait (CBK) has launched a regulatory sandbox (called ‘Wolooj’) and issued a comprehensive Open Banking framework. One of the first comprehensive Open Banking frameworks in the region, this allows fintech startups and banks to safely test new digital banking products (like open APIs, digital wallets, and AI-driven financial services) under CBK oversight. The open banking regulations, rolled out in 2025, encourage banks to collaborate with fintech companies and give customers more control over their financial data. By proactively updating rules and encouraging experimentation, the Central Bank hopes to spur a wave of fintech innovation. From mobile payments and peer-to-peer lending to personal finance apps. All the while keeping risks in check. Early results are promising. A digital ecosystem where multiple Kuwaiti banks are piloting open API services, and a homegrown fintech firm approved to trial open banking services in the sandbox. At the same time legislation has been adapting to the new landscape.

AI-Powered Banking Services: Established banks in Kuwait are also evolving. Leading Islamic banks such as Boubyan Bank, as well as conventional players like National Bank of Kuwait (NBK), are investing in AI-driven customer onboarding and biometric KYC solutions. For example, some banks now use facial recognition or fingerprint biometrics to let customers open accounts or apply for loans remotely, with AI algorithms instantly verifying IDs. A process that used to take days now is done in minutes.

Kuwait’s banking sector, guided by the Central Bank, mandated biometric registration for all customers recently as a security measure, and even froze accounts of those who failed to provide fingerprints. These measures underscore how seriously Kuwait takes fintech modernization and security. Banks are also deploying AI chatbots (Boubyan’s ‘Msa3ed’ being an example) for customer service and using data analytics to personalize product offerings. The upshot is a banking experience that is increasingly digital-first and user-centric, aligning with global fintech trends.

Booming Digital Payments: Thanks to high internet and smartphone penetration, Kuwait has seen a surge in digital payments and fintech adoption. Cashless transactions have soared. A recent study showed Kuwait now leads the GCC in digital payment usage, with about 92 percent adoption of non-cash payment methods, and 99 percent of in-person payments being contactless via tap cards or mobile wallets. The Central Bank’s promotion of platforms like K-Net (a national electronic payments network) and support for Apple Pay, Samsung Pay, etc., have greatly modernized the consumer payment landscape. Fintech startups are emerging in areas like e-wallets, online remittances, and buy-now-pay-later services, often under the wing of the Kuwait Fintech Center or supported by venture funding from local investors. The government’s emphasis on cybersecurity (as highlighted by partnerships with companies like Visa to improve fraud prevention) further boosts public trust in digital finance. All these factors contribute to a vibrant digital economy where money moves faster, and new financial products can take root.

Startup Ecosystem: Kuwait’s broader startup ecosystem is steadily expanding, especially in digital sectors. By some counts, over 120 tech startups have been incubated or funded through government programs like KuwaitTech and by organizations such as KFAS and the National Fund for SMEs. Many of these startups focus on fintech, e-commerce, logistics tech, and online services. Reflecting the digital needs of a young, connected market. The government has introduced business-friendly reforms (easier licensing, startup visas, funding schemes) to encourage entrepreneurship. Notably, a ‘Digital Future Fund’ was established with a $200 million allocation specifically to invest in Kuwaiti tech startups and AI ventures. Early success stories include fintech apps for Islamic banking, ride-hailing and delivery services, and e-learning platforms that are now scaling in the GCC region. While Kuwait’s startup scene is smaller than that of the UAE or Saudi Arabia, it is growing rapidly and benefits from strong public-private support networks. Each successful startup further validates the possibility of a diversified, innovation-led economy beyond oil.

Key National AI and Digital Economy Players:

Kuwait’s digital transformation involves a constellation of government agencies, research bodies, and companies each playing a role:

(Together, these players form the backbone of Kuwait’s digital ecosystem. Combining government direction, funding, talent development, and enterprise-level execution.)

From Oil to Algorithms: The New Kuwaiti Narrative:

Kuwait’s transformation from an oil-based economy to a digital-driven future is characterized by a few distinctive traits:

Low Profile, High Impact: Unlike some of its Gulf peers, Kuwait has been relatively quiet in its digital rise, making steady progress without constantly seeking the spotlight. The impact of that progress is now being felt. Major tech investments are translating into tangible outcomes: faster government services, new tech jobs, and increased foreign investment interest. As one regional tech expert remarked, Kuwait “has always had the capital and the talent but now it is matching that with bold digital execution,” with momentum building to the point that it is only a matter of time before the region and world take closer notice. In other words, Kuwait is becoming a ‘sleeping giant’ in GCC tech, content to let results speak louder than hype.

Scale and Sustainability: Kuwait’s digital strategy is built for national scale and long-term sustainability rather than quick wins. The state-led approach, backed by the massive KIA fund, treats digital transformation as a form of industrial policy and even national security strategy.

Public-private partnerships are robust: Telecom companies, banks, and global tech firms are all tied into executing the national vision. Kuwait is also careful to balance rapid innovation with stability. For instance, rolling out new fintech services in a controlled sandbox to get regulations right. This measured approach means Kuwait’s digital infrastructure and policies are being designed to stand the test of time. The country is effectively future-proofing its economy, ensuring that today’s projects (from smart grids to AI education) will yield sustainable benefits for decades. In the GCC context, where regional influence will hinge on prowess in AI, data, and connectivity, Kuwait’s focus on ‘digital neutrality, internal know-how, and a young talent base’ positions the country for the long game.

Navigating Challenges: The journey is not without challenges. Kuwait recognizes that it must continually update its regulatory frameworks, data privacy laws, and cybersecurity defenses as it goes digital. For example, crafting comprehensive personal data protection rules is on the to-do list, as is enhancing legislation to combat cyber threats. There is also the ongoing task of streamlining bureaucratic procedures to be more tech-friendly (a known hurdle in Kuwait’s public sector). However, these issues are being actively addressed. New cybersecurity centers have been established, and draft data privacy regulations have been introduced. Officials stress that the opportunities far outweigh the challenges, and that maintaining public trust through strong cyber safeguards is paramount. By tackling these concerns head-on, Kuwait is strengthening the foundations of its digital future even as it builds upon them.

To conclude, Kuwait is quietly shifting its national narrative from oil to algorithms, backed by prudent investment and strategic vision. The country has managed a digital leap in a short time without much fanfare. It is now positioning itself as a formidable digital disruptor in the Gulf. From nearly ubiquitous 5G coverage and AI-enabled services to a generation of youth being trained for high-tech jobs. Kuwait’s story is one of ‘low noise, high momentum’ progress.

The nation’s economic engine, once fueled solely by hydrocarbons, is increasingly powered by cloud computing, data centers, and code. If current trends continue, Kuwait’s transformation could well become a model of sustainable digital development. One where a rich state reinvented itself through technology, while preserving the stability and welfare of its people. Do not let the lack of buzz fool you: Kuwait’s digital revolution is real, and it is building towards a breakthrough moment. The Gulf’s quiet achiever may soon demand a much louder share of the region’s tech spotlight.