Kuwait sets new ethics and integrity rules for insurance professionals

Compliance, integrity, and client transparency key for insurance firms

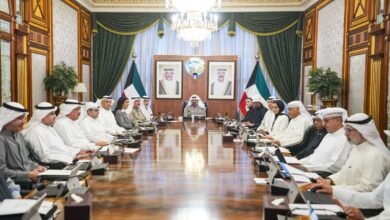

Mohammed Al-Otaibi, Chairman of the Supreme Committee for Insurance Regulation, has issued a decision establishing rules for compliance with professional ethics, competence, and integrity for all licensed insurance practitioners.

The decision mandates that internal work regulations be approved by the Board of Directors according to the institution’s size and nature, in line with the unit law and its executive regulations, reports Al-Rai daily.

The CEO, or an appointed executive, will be responsible for implementing these rules.

Compliance with the ethics and professional standards will begin on January 1, 2026, and the decision will be published in the Official Gazette.

The rules emphasize recruiting qualified people with strong academic, professional, technical, and ethical credentials, including a clean criminal record.

Foreign employees must submit a certificate of no criminal convictions, verified by their home country and the Kuwaiti embassy.

The regulations also specify obligations for practitioners, including dealing in good faith, ensuring transparency and disclosure, understanding clients’ needs, updating clients on developments, following up diligently on requests, and maintaining confidentiality.

Additionally, conventional and Takaful insurance companies are required to publicly disclose their governance framework, controls, risk management practices, organizational structure, complaint procedures, insurance products, and financial data on their websites, available in both Arabic and English.

Follow The Times Kuwait on X, Instagram and Facebook for the latest news updates