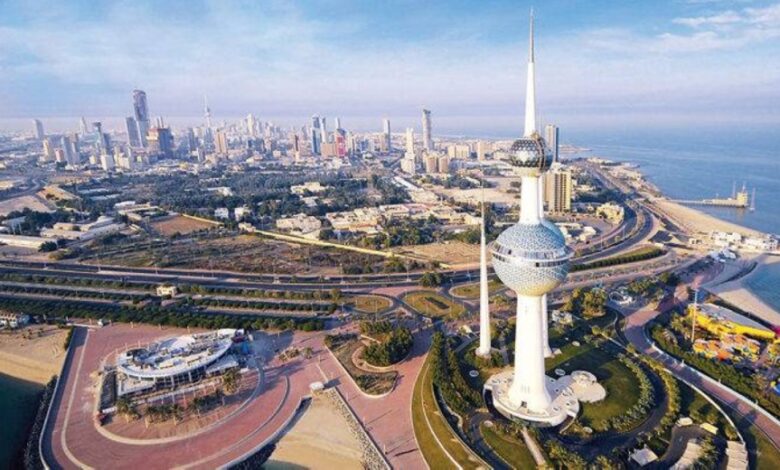

Kuwait leads Gulf in project growth with $227 billion market value

The latest report by MEED magazine revealed that the Gulf Projects Index continued its upward trend for the seventh consecutive month, growing by 0.4 percent, or $20 billion in value, during the four weeks from September 12 to October 10.

The report noted that the Saudi and UAE markets returned to stronger growth following two months of slower activity, during which smaller Gulf states had driven the index’s expansion, reports Al-Rai daily.

For the second consecutive month, Kuwait recorded the highest growth rate in the region, with the projects market increasing by 2.6 percent, adding $5.7 billion in value to reach a total of $227 billion since the beginning of 2025. This performance secured Kuwait fifth place among Gulf countries in terms of total project market value.

Last month, Kuwait’s projects market grew by 2 percent, also the highest in the region, pushing total project value to $222 billion. MEED attributed the recent growth primarily to upward revisions in the value of three major Kuwait Oil Company projects, following more precise cost assessments after the receipt of new bids.

In comparison, Saudi Arabia, the Gulf’s largest projects market, recorded a 1 percent increase—equivalent to $19 billion in added value—during the same period. The UAE followed closely, also growing 1 percent and adding $10.5 billion to its total project value.

Across the wider Middle East and North Africa (MENA) region, the total value of contracts signed in September reached $15.5 billion, representing a notable decline compared to the higher figures recorded in the previous two months, and falling below the region’s 2025 monthly average.

Kuwait alone registered $148 million in signed deals during September, including its largest contract—an $84 million agreement awarded by the Kuwait Oil Company to develop a five-mode well tie-in facility and associated works.

The report underscores Kuwait’s growing momentum in project development, supported by energy sector investments and revisions in key infrastructure and oil contracts that continue to strengthen the national projects market.