India’s upsurge in innovation index reflects government’s strong desire to walk the talk

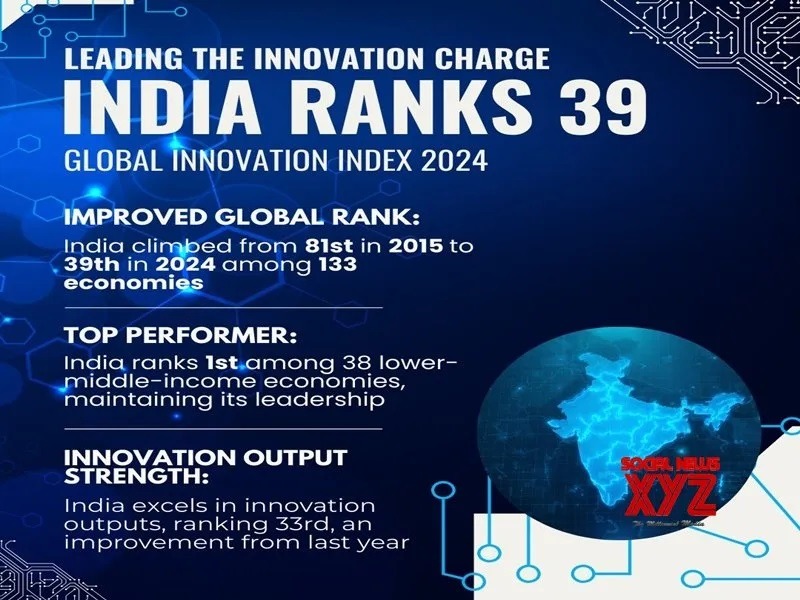

India climbed 42 positions in nine years to reach 39th ranking in the Global Innovation Index (GII) 2024 list, a morale-boosting achievement for the country which promised to shine a decade ago when a new government was formed under the leadership of Prime Minister Narendra Modi.

As per the data released by Geneva-based World Intellectual Property Organization, India ranked 40 in 2023.

The latest ranking showed Switzerland, Sweden, the United States, Singapore and the United Kingdom are the world’s most innovative economies, while China, Türkiye, India, Vietnam and the Philippines remained the fastest 10-year climbers.

The Global Innovation Index 2024 (GII) takes the pulse of innovation against a background of steady but slow global economic growth, shrinking innovation finance and sluggish productivity.

It reveals the most innovative economies in the world, ranking the innovation performance of around 130 economies while highlighting innovation strengths and weaknesses.

In the GII ranking of 130-plus economies, China reached the 11th position and remains the only middle-income economy in the GII top 30.

A total of 19 economies outperformed on innovation relative to their level of development. India, the Republic of Moldova and Vietnam are all innovation overperformers for 14 years in a row.

On India’s position, the report said: “India leads the lower middle-income group. It holds the record for overperforming on innovation for the 14th consecutive year. India’s strengths lie in key indicators such as ICT (Information and Communications Technology) services exports (at first place, globally), venture capital received and intangible asset intensity. India’s unicorn companies also secure the country the 8th rank globally.”

Indian PM Narendra Modi described this achievement as a “remarkable feat,” emphasizing the government’s dedication to building a vibrant innovation ecosystem that can transform opportunities for the nation’s youth.

The country continues to walk on the path of innovation and the government’s futuristic approach was evident when Modi dedicated to the nation three PARAM Rudra Supercomputers worth around Rs 130 crore (1300 million) via video conferencing recently.

Developed indigenously under the National Supercomputing Mission (NSM), these supercomputers have been deployed in Pune, Delhi and Kolkata to facilitate pioneering scientific research.

The Prime Minister also inaugurated a High-Performance Computing (HPC) system tailored for weather and climate research.

During his recent visit to America, Modi pitched the country as a land of opportunity when he said the nation has now emerged as a bigger market in 5G technology than the USA.

“Today India’s 5G market has become bigger than America and this has happened within just two years,” Modi said while addressing an Indian diaspora event in New York where he received a rousing welcome after he reached the venue.

He said India is working on ‘Made in India’ 6G technology at present.

Hopefully, the country will witness further forward movement in the global innovation ranking in future.

In another achievement for India, the country topped the global IPO market, with 227 transactions totaling $12.2 billion in the first eight months of 2024, as per data shared by Global Data.

This clearly shows that good governance and proper business environment creation as proposed by the government since coming to power in 2014 is finally taking its shape.

“The remarkable performance was driven by strong market sentiment, a favorable macroeconomic environment, and a surge in investor interest fueled by fear of missing out (FOMO),” said leading data and analytics company GlobalData.

Both the SME and mainboard IPO segments have contributed to this success, supported by strong demand from local retail investors and institutions, reveals GlobalData.

An analysis of GlobalData’s Deals Database reveals that while the number of IPOs globally declined in the first eight months of 2024, the total deal value saw a significant surge.

A total of 822 IPOs were registered with an aggregate deal value of $65 billion, reflecting a 17.4% rise in value compared to the $55.4 billion from 1,564 listings during the same period in 2023.

This indicates a shift towards larger, more valuable IPOs despite the reduced number of listings.