Despite Global Headwinds, Kuwait Economy to Grow in 2026

The Times Kuwait Report

After a resilient start in the first-half of 2025, global economic growth appeared to moderate by year end. The robust resilience witnessed in the first six months is now largely attributed to temporary factors such as the front-loading of trade, investment, and inventory management strategies, rather than core strengths in the global economy. With uncertainty about the stability and trajectory of the world economy remaining acute, global growth in 2026 is forecast to be subdued.

Despite tariff shocks unleashed by the United States in April, overall global economic activity performed better than expected, as most tariff impacts were tempered through one-on-one deals and resets. Nevertheless, headwinds from the heightened incertitude raised by the tariff announcements, have fueled protectionism, trade fragmentation, and non-tariff barriers that could impact global growth prospects in 2026.

According to projections by the International Monetary Fund (IMF), global growth is projected to slow from 3.3 percent in 2024 to 3.2 percent in 2025 and 3.1 percent in 2026, with advanced economies growing around 1.5 percent and emerging market and developing economies just over 4 percent. Global trade volume is also forecast to grow at a much slower rate than the 3.5 percent exhibited in 2024-25, to average around 2.9 percent in 2025–26. Meanwhile, inflation is expected to decline by 0.5 percent to 3.7 in 2026, however, in the US it could remain above-target.

The latest World Economic Outlook report by the IMF noted that risks to global growth remain tilted to the downside, with prolonged policy uncertainty, escalation of protectionist measures, and trade fragmentation dampening consumption, discouraging investment, disrupting supply chains, and stifling productivity growth in 2026. Major shocks to labor supply, mainly from restrictive immigration policies could also reduce growth, especially in states with aging populations or skill gaps.

Additional upsets could arise from artificial intelligence (AI) failing to deliver on its productivity gains and earnings expectations, tamping down financial market exuberance and potentially impacting broader macrofinancial stability. Commodity price spikes, from climate shocks or geopolitical tensions, could also pose risks, especially for low-income, commodity-importing countries.

On the upside, a breakthrough in trade negotiations could lower tariffs and non-tariff barriers, as well as reduce market uncertainty. Renewed reform momentum, credible, predictable, and sustainable policy actions, and productivity gains from AI that bring economy-wide, inclusive gains could further boost medium-term global growth.

The Fund urged policymakers, particularly in emerging and developing states, to establish clear, transparent, and rules-based trade policy road maps, to reduce uncertainty and support investment, and to reap the productivity and growth benefits that accrue from more trade. Modernizing trade rules to align with the digital age, ensuring stronger multilateral cooperation, calibrating monetary policies to balance price stability and growth risks, and implementing fiscal policies that combine spending rationalization and revenue generation, could boost growth.

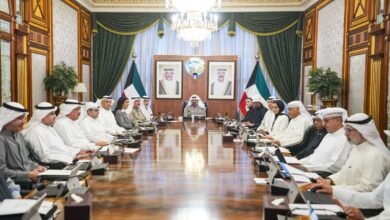

Amid subdued prospects for the global economy in 2026, recent media reports indicate that Kuwait’s initiatives over the past year, in particular, updates to the country’s legislative framework, are expected to spur economic growth in 2026. The government aims to leverage the new legislative frameworks as a structural reform tool to align economic growth with global sustainable development goals for 2030, and push forward Kuwait’s ambitious Vision 2035 development plan.

Implementing the updated legislative framework is also expected to strengthen transparency and accountability in government institutions, achieve social justice and equality before the law, and ensure sustainable stability. Latest insights on the local economy, by the National Bank of Kuwait (NBK), lends further credence to the positive view on Kuwait’s growth prospects in the new year.

According to analysts at NBK, improvements in the economic environment—higher project awards, improved real estate activity, and stronger credit growth—could help push non-oil GDP to a five-year high of 3.3 percent in 2026. Boosted by rising oil output, overall GDP is forecast to hover around 4.5 percent in 2026. Meanwhile, fiscal deficit is expected to widen to 4.9 percent of GDP in financial year 2025/26, before narrowing slightly in 2026/27 as oil production rises, non-oil revenues expand, and authorities maintain a firm control on spending.

Additionally, the reforms initiated last year aim to reduce legal and procedural risks for investors, encourage innovation, enhance entrepreneurship, and improve market efficiency through fair competition by curbing monopolistic and illegal practices. These initiatives are expected to positively impact growth rates, job creation, and productivity.

As a key step to support innovation and entrepreneurship, the cabinet approved in November last year a draft law providing comprehensive regulation for digital commerce that enhanced investment attractiveness in the digital economy, balancing economic freedom with regulatory oversight, and supporting sustainable development objectives.

In efforts to reinforce financial stability and support economic growth, Decree-Law 60 of 2025 on financing and liquidity was issued in March last year. The law sets a public debt ceiling of KD30 billion and allows issuance of financial instruments with maturities of up to 50 years, granting the authorities greater fiscal flexibility to access local and international markets and improve liquidity management.

To enhance transparency in real estate transactions, the Ministry of Justice issued Decision 194 of 2025, which requires all real-estate transactions to have proof of payment through bank transfers or certified checks. The decision aims to support anti-money laundering efforts, limit fictitious mortgages, and put an end to legal loopholes previously exploited for unlawful transactions.

Decree Law No. 58 of 2025 published in April made key amendments to the Bankruptcy Law No.71 of 2020, in the Civil and Commercial Procedures Law, which introduced a rehabilitation-focused framework on debtors. The new amendments deleted articles in the 2020 law, and reinstated the power to arrest and imprison debtors, who have the financial solvency but intentionally refuse to settle final judgments. These changes balance debtor rehabilitation with stronger creditor protection, reinforcing the legal obligations of those who can pay their debts.

In August, Decree Law 89 of 2025 entered into force, amending certain provisions of Law 118 of 2023 on establishing and developing residential cities or areas economically, known as the real estate developer law. The amendments granted developers greater flexibility to offer diverse housing products tailored to varying family needs, capacities, and unit sizes, supporting market responsiveness and housing supply diversity.

In a major step toward economic reform, fair investment conditions, and tax equity, the Ministry of Finance issued in January 2025 the executive regulations for the decree law on the tax on multinational enterprise groups. The regulations clarify legal provisions, define procedures and implementation mechanisms, enhance transparency, and provide clear guidance to stakeholders in line with international standards and guidelines.

To safeguard financial security and strengthen anti-money laundering efforts, the cabinet approved in December 2025 a draft decree law, adding Article 12 bis to Law 111 of 2013 on commercial shop licensing. The amendment criminalizes alternative remittance systems, considered among the most dangerous illegal financial practices and a serious threat to Kuwait’s financial and economic security.

The government’s proactive approach signals a new phase of institutional reform aligned with global developments and Kuwait’s development vision. The reforms balance social, criminal, and economic pillars, reflecting a comprehensive development vision that recognizes economic reforms cannot succeed without parallel social and judicial reforms ensuring justice and stability.

The reforms are expected to enhance transparency and efficiency of government institutions, improve business climate, raise non-oil sector growth, encourage greater private-sector participation and foreign investments in the economy, increase employment opportunities for national youth, and overall boost the country’s sustainable growth and development going into the future.