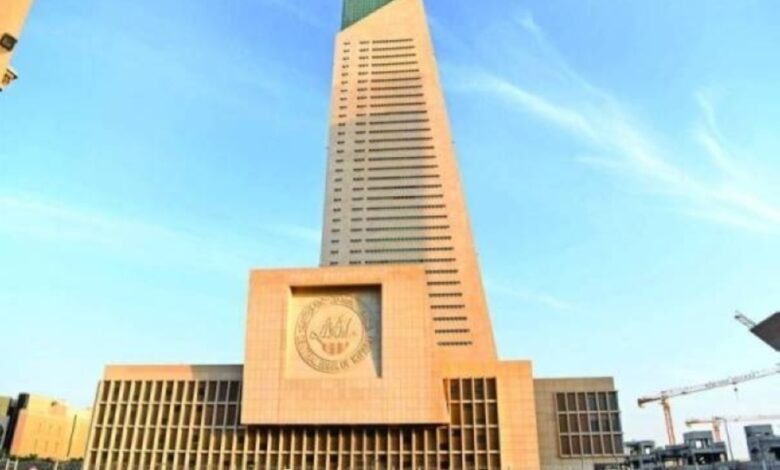

Central Bank of Kuwait approves updated customer protection guide

The CBK concluded by reaffirming its commitment to enhancing the performance of Kuwait’s banking sector, ensuring fair and transparent treatment of all customers, and advancing financial inclusion in accordance with international standards.

The Central Bank of Kuwait (CBK) announced that its Board of Directors has approved an update to the Bank Customer Protection Guide during its meeting on Monday.

The CBK Governor stated that the amendments align with the Bank’s efforts to strengthen transparency and protect customer rights, in line with international best practices and recent regulatory and technical developments.

The goal is to create a banking environment that ensures fair treatment and enhances the efficiency of customer protection in dealings with local banks.

In line with the CBK’s focus on financial inclusion, the updated guide also addresses the provision of banking services for people with special needs, ensuring equal access to financial products and services for all segments of society.

The revised guide combines previous instructions issued on July 5, 2015, creating a single, comprehensive framework for customer protection.

Among the key updates introduced:

Enhanced Transparency — Banks must provide customers with a clear document outlining essential product or service details — including fees, obligations, and conditions — before signing any contract.

Clear Contract Procedures — New guidelines govern how banks prepare, amend, and notify customers about changes in contracts.

Disclosure Requirements — Banks must inform customers about deposit interest rates, due dates, and any changes that occur.

Annual Percentage Rate (APR) — Banks are required to disclose the APR, showing the full cost of credit including interest and fees.

Financial Tools — Banks must provide online calculators for loans and credit cards to help customers calculate installments, interest rates, and fees based on their inputs.

Data Privacy — Stronger measures have been added to protect customer confidentiality and regulate information sharing with third parties.

Financial Inclusion Enhancements:

- Clear mechanisms for handling accounts for minors, including notifying guardians and promoting financial awareness.

- Privacy guarantees for customers with special needs, allowing them to conduct transactions without witnesses unless requested, and ensuring that bank websites and apps meet international accessibility standards.

- Guidance on providing appropriate services for low-income customers and domestic workers.

Advertising Rules — Banks must clearly state the terms and conditions of “free” offers to prevent misleading promotions.

Complaint Handling — The response period for customer complaints has been reduced from 15 to 5 working days, and banks must establish performance indicators to track complaint handling and customer satisfaction, reporting results quarterly to management.

Banks are required to implement the guide immediately, with full compliance expected by April 2026.

The updated Bank Customer Protection Guide is available on the Central Bank of Kuwait’s official website.

The CBK concluded by reaffirming its commitment to enhancing the performance of Kuwait’s banking sector, ensuring fair and transparent treatment of all customers, and advancing financial inclusion in accordance with international standards.

Follow The Times Kuwait on

X, Instagram and Facebook for the latest news updates