Kuwait approves GCC payment link agreement to boost regional financial integration

New Gulf system aims to enhance stability, settlement, and clearing operations; Central banks granted supervisory powers over unified GCC payment network; agreement strengthens Kuwait’s role in regional banking and trade cooperation

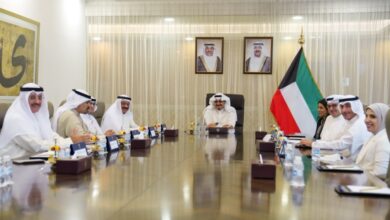

The Council of Ministers has issued Decree-Law No. 130 of 2025 approving the agreement to link payment systems between Gulf countries. The agreement, originally signed on February 16, 2022, was endorsed by the Cabinet following its submission by the Minister of Foreign Affairs.

This decision is based on the GCC Charter, the Unified Economic Agreement, and the resolutions of the Supreme Council’s 37th session held in Manama in December 2016, which called for the development of a unified Gulf framework for linking payments.

The move is seen as a key step toward enhancing financial stability and building a common infrastructure for settlement, clearing, and cross-border financial transfers among member states.

The agreement aims to strengthen Gulf economies and enhance their competitiveness amid global economic shifts.

According to the explanatory memorandum, its goals include:

- Establishing a system to link payment and settlement networks between GCC countries for cross-border transfers and payment orders.

- Enhancing the integrity and efficiency of joint Gulf payment systems, reducing risks, and safeguarding financial stability.

- Granting supervisory and regulatory powers to central banks to oversee and develop payment systems.

- Strengthening clearing operations through standardized mechanisms and procedures.

- Building a regional infrastructure capable of supporting real-time settlement systems, facilitating transactions in local GCC currencies, and improving financial integration across the region.

The agreement entrusts the Committee of Governors of GCC Central Banks with supervisory and regulatory responsibilities. This includes setting frameworks, establishing companies to manage and operate the system, and ensuring settlement guarantees even in cases of bankruptcy.

Central banks will be responsible for:

- Managing and developing payment systems in line with international best practices.

- Ensuring the settlement of all transactions executed through the system.

- Managing liquidity, exchange rates, and financial guarantees to maintain system continuity.

- Establishing mechanisms to safeguard cross-border settlements, including a fund to guarantee transactions.

- Setting participation rules for local institutions and addressing risks related to defaults.

The memorandum emphasized that the agreement does not conflict with Kuwait’s Arab or international commitments. Instead, it strengthens Kuwait’s role in regional financial and banking cooperation, while laying the groundwork for deeper integration of Gulf financial markets and more efficient cross-border trade and investment.

Follow The Times Kuwait on X, Instagram and Facebook for the latest news updates