Banks warn exchange companies to close accounts or face seizure

Banks closing exchange company accounts cited account-opening conditions but didn’t specify the issue, stating that without review within ten working days, balances will be retained and accounts closed.

• Some banks view the closure of exchange companies’accounts within a specific timeframe, or the risk of the banks closing them and seizing the balances, as a strategy to reduce exposure to exchange firms, limit ties, and enforce stricter account-opening criteria in line with FATF anti-money laundering guidelines.

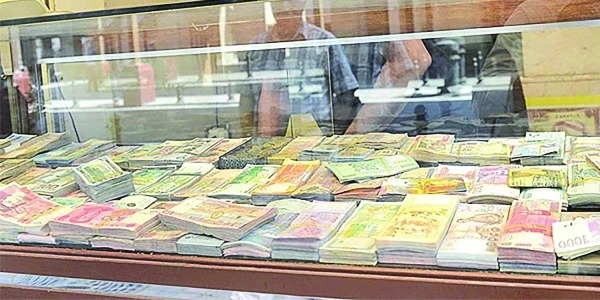

Some local banks have started reaching out to exchange companies, urging them to close their accounts within a specific timeframe or risk the banks closing them and seizing the balances.

While the banks have not provided specific reasons, some believe this is a strategy to reduce exposure to exchange companies, limit business ties, and set stricter criteria for opening new accounts in line with the Financial Action Task Force (FATF) recommendations on combating money laundering and terrorist financing, Al Rai newspaper reported.

The sources said that the banks that adopted the procedure of closing the accounts of some exchange companies simply stated that their request was based on the conditions for opening accounts, without specifying the issue that led to the request to review the need to withdraw the available balance or transfer it to other accounts with local banks and close the account. They added that if no review occurs within ten working days from the date of receiving the warning letter, the bank will retain the available balances and close the account.

The sources mentioned that the companies covered by the report had contacted Al-Munther Bank to clarify the reason for this sudden shift, especially since no procedural changes have occurred in their operations recently, most notably the controls on dealing in foreign currency and providing sufficient guarantees for foreign currency coverage required to feed their network of external correspondents.

They indicated that they have not yet received any banking explanations, despite the fact that the timeframe for closing the accounts and preserving the balances is still temporary, which encourages them to file a complaint with the Central Bank of Kuwait, given that they are under its supervision.

While the measure did not include the closure of accounts for major exchange companies, the sources noted that the current cases pose a significant challenge to the sector, which could hinder the financial role of these companies in maintaining and strengthening the official exchange market against shadow exchanges. This is especially concerning since the companies affected have a network of multiple branches across various regions.

They also indicated that refraining from dealing with these companies without official instructions could extend to other banks, increasing the risk that they may lack coverage for the foreign currencies necessary to conduct their activities, leading to growing fears of their future inability to carry out financial transfers for both citizens and residents.

For their part, banking sources revealed to the newspaper that the closure of some exchange companies’ accounts is part of a cautious banking approach based on the degree of risk and strict adherence to due diligence procedures, especially for corporate and exchange company accounts. They pointed out that the Central Bank leaves it to each bank to decide whether to begin or continue dealing with this category of customers, based on the degree and sensitivity of the risks to which it is exposed, as well as its assessment and hedging of these risks.

The sources explained that the banks’ stance on some exchange companies stemmed from the high-risk activity their accounts represented and their inability to assess or verify the quality of their implementation of anti-money laundering and counter-terrorism financing controls.

Sound practices for risk assessment

In the same context, officials at exchange companies told the newspaper that the dispute is not about the strictness exercised by banks in auditing their sector’s data, as this is in line with the requirements of global regulatory standards, oversight mechanisms, procedures, and sound practices for risk assessment.

However, they expressed reservations about closing accounts without a specific reason, which they believe violates the terms of the contract with the bank. They explained that if the bank finds specific suspicions regarding an exchange company, it must inform the company and take legal action, rather than closing its account based on general suspicion, especially since these accounts belong to companies under the supervision of the Central Bank.

Opponents of the transformation

- Those affected are under the supervision of the Central Bank, and no changes have occurred in their operations.

- The concern is not about strict banking practices but about closing accounts based on general suspicion.

- There are concerns about the increasing risks of a weak foreign currency supply to correspondents, which could lead to defaults.

Supporters of the measure

- Banks are committed to anti-money laundering and counter-terrorism financing recommendations.

- Restricting exposure to exchange companies is part of efforts to reduce risky relationships.

- The Central Bank grants banks the authority to decide how to deal with clients based on risk sensitivity.

KD 240 million in 3-month bonds and tawarruq

The Central Bank of Kuwait announced its latest issuance of bonds and tawarruq, totaling KD 240 million for a three-month term. The rate of return on this issuance is 4.125 percent.