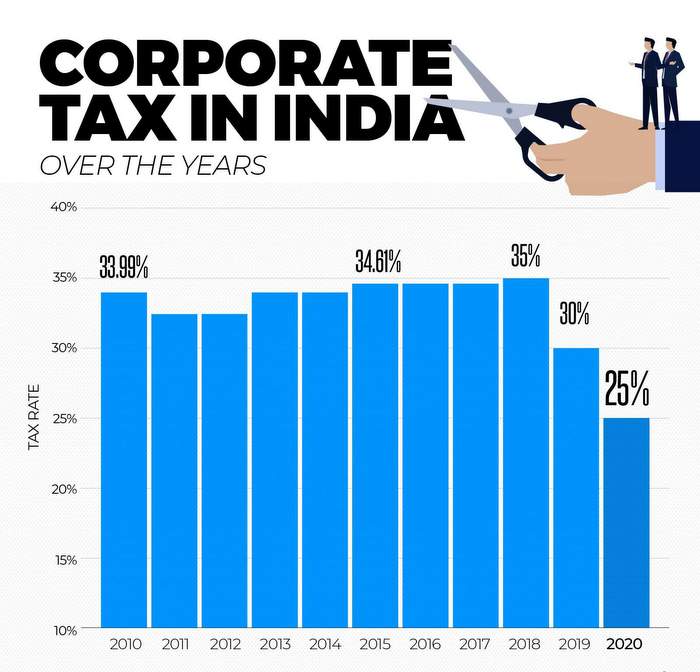

Indian Finance Minister Nirmala Sitharaman,who chaired a meeting on Friday of the all-powerful federal indirect-tax entity, the Goods and Services Tax (GST) Council, has announced a slew of measures intended to kick-start the economy. Earlier in the week, the government had slashed corporate taxes worth Rs1.4 corporate taxes 5 trillion paid by domestic manufacturers in a bid to rejuvenate corporate vivre and attract private investments. In response, equity markets notched their best day in over a decade.

The new corporate tax structure makes the country one of the lowest tax regimes in Asia. Manufacturing companies not availing of other tax sops can now opt for a 22 percent corporate tax rate, while new manufacturing companies that register and start production between 1 October and March 2023 can avail an even lower tax rate of 15 percent.

The new tax reliefs released on Friday are seen as an attempt to support small and medium enterprises, promote exports and revive economic growth. The steps announced include easing the compliance burden on small businesses, as well as tax cuts on hotel stays, outdoor catering and a whole set of other diversified items.

On the other hand, the finance minister more than doubled the tax on caffeinated beverages to 40 percent through a GST of 28 percent plus an additional cess of 12 percent; earlier the rate was 18 percent. A uniform GST rate of 12 percent will also be levied on woven/non-woven polyethylene bags.

The Council, however, rejected proposals for tax cuts on automobiles and biscuits as it wanted to focus more on the unorganised sector in giving tax relief. All rate changes will come into effect from 1 October.