Perhaps it goes without saying that the rise in oil prices since the beginning of 2022 enhances the financial strength of Kuwait and the Gulf in general, both at home and abroad, as it brings in a torrent of exceptional cash flows.

On account of the recorded increases, it is hoped to fill the pockets of the general reserve again, to the extent of extinguishing the deficits of the last fiscal year, and to achieve an appropriate surplus that can be absorbed in the implementation of its delayed and future projects, investment, housing and development, reports a local Arabic daily.

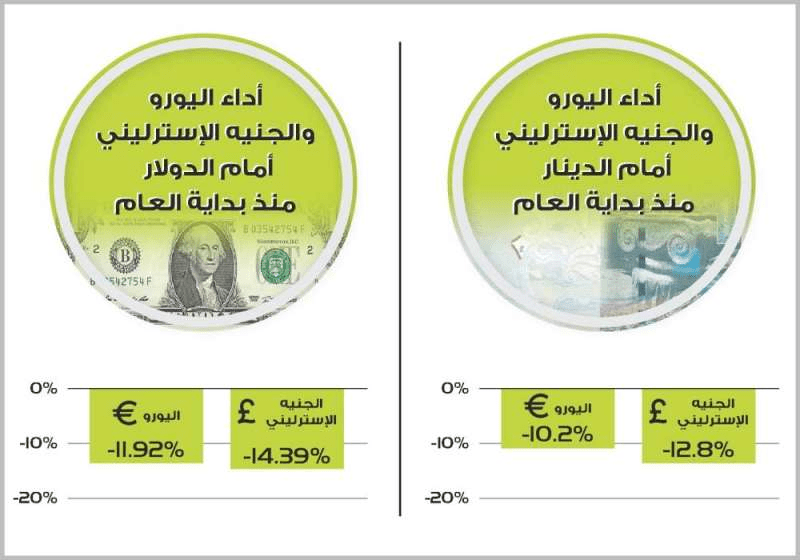

Perhaps what distinguishes the exceptional gains achieved by Kuwait’s budget this time is that their benefits did not come singly, but rather double, in addition to the fact that the price of a barrel reached 130 dollars, and that it did not retreat from 100 since the beginning of 2022, which constituted a growth in revenues by more than double, compared to last year, highlighting the importance of the money turnover generated by oil sales and the strong dollar, which rose last Tuesday to its highest level in 20 years against other major currencies.

With oil maintaining its 3-digit prices for about 9 months, and the rise of the dollar index, which accounts for 88 percent of Kuwait’s oil revenues, to a new peak it hasn’t reached in two decades at 109.48, the budget records double hikes, constituting additional financial strength.

The dollar’s strength helps keep the cost of Kuwait’s imports low, given that the majority of its export sales are in this currency as well as its purchases, which raises its current account surplus.

Unlike the rest of the world, Kuwait does not face the same level of pressure from rising commodity prices. Domestic inflation is around 4.5 percent on an annual basis, while prices in major economies have recorded record levels not seen in decades.

Financially and from the monetary point of view Kuwait’s support for the prices of fuel and other commodities, and the availability of the dollar from its high-value oil sales, in addition to the positive impact of the rise in the dollar’s weight in the basket of currencies pegged to the dinar, reduces the threat of imported inflation, and keeps its impact limited compared to the countries of the world, especially oil-consuming countries.

Of course, this does not mean that Kuwait and other Gulf countries are not vulnerable to the impact of the global rise in commodity prices, represented by the rapid increase in grain prices and the disruption of the agricultural supply chain caused by the Russo-Ukrainian war, but that high oil prices and a strong dollar at the same time contribute to alleviating the negative repercussions Therefore, contrary to the fires burning in the budgets of several countries, pricing the majority of Kuwait’s imports in dollars makes it less expensive.

The Economist Intelligence Unit estimated that inflation rates in the Gulf will be among the lowest in the Middle East and North Africa in 2022-2023, while inflation in Britain last July recorded its highest level in 40 years, as the country faces the possibility of a recession, while it reached The inflation rate in the euro area on an annual basis was 8.9 percent in July, compared to 8.6 percent in June.